10 steps for setting up a limited company

Are you thinking about forming a limited company but feeling a bit overwhelmed? If you’re unsure where to start or want to know more about what’s involved, we’ve got all the information you need right here!

Jump to a section or read on to take it all in:

- Is a limited company right for your business?

- Public or private?

- Choose a name for your company

- Register your limited company

- Appoint a director

- Shareholder or guarantor

- Gather the required documentation

- What records do you need to keep?

- Consider accounting software

- Open a business bank account

1. Is a limited company right for your business?

Choosing how to structure a new business is a big decision and forming a limited company is just one of the options available.

Setting up a limited company means creating a separate legal entity from yourself, even if you’re the founder. Any profits will belong to the company (not you) and in order to receive income you will need to withdraw money as salary payments, dividends or a loan.

If you choose to set up as a sole trader instead - a popular option for small business owners - you’ll have complete control of your business and will keep all profits after tax. The formation process is more simple for sole traders than it is for limited companies. However, choosing the sole trader option also comes with some risk as you’ll be financially liable for anything that goes wrong with the business.

So what are the advantages of forming a limited company?

- You won’t be personally liable for financial losses.

- The company’s name will be protected by law.

- Transferring ownership of a company is straightforward.

- You may pay less personal tax than you would if you were a sole trader.

Check out our guide on the advantages and disadvantages of trading through a limited company to get a better idea if it’s the right fit for your business.

2. Public or private?

If you decide to go ahead with setting up a limited company, you’ll need to decide which type of company you’d like to form. The options are:

- A public limited company (PLC).

- A private limited company (LTD).

PLCs must have at least £50,000 in share capital with at least two shareholders, two directors and a company secretary. Therefore, it’s often more suitable for startups, small businesses, contractors and freelancers to form a private limited company (LTD).

3. Choose a name for your company

This is the fun part! Take time to read the Companies House naming rules and our helpful guide on registering a business name.

4. Register your limited company

You’ll need to register your company with Companies House.

This will involve registering an official address and a standard industrial classification of economic activities (SIC) code, which identifies what your company does. You can check what your company's SIC code is on the government website.

You can register for Corporation Tax at the same time as registering your company. There’s a different way of doing this if you register with Companies House separately. You’ll need to register for Corporation Tax within three months of when you start doing business.

Once you’ve registered your business with Companies house, you’ll receive a ‘certificate of incorporation’ to confirm that the company legally exists, with the company number and date of formation. Your company should be registered within 24 hours for the cost of £12 if you apply online.

5. Appoint a director

You can’t have a limited company without appointing at least one director.

As the owner of the business, it’s likely that you’ll be one of the company directors. This means that you’ll be legally responsible for company records, accounts and performance. The director’s name and personal information will be publicly available from Companies House, alongside the service address. If you would feel uncomfortable about providing your home address and having it made public, you can ask for it to not be included on the register.

Appointing a company secretary is optional. Company secretaries are often appointed to reduce the legal duties of the company directors but the individual responsible for these duties can also be a director. Bear in mind that the role of secretary can’t be assigned to the company’s auditor or an ‘undischarged bankrupt’ (a bankrupt person who is not granted an ‘order of discharge’ by a court and is thereby disqualified from holding certain public and private offices).

6. Shareholder or guarantor?

A limited company must have at least one shareholder or ‘guarantor’, who can also be a director.

The majority of limited companies are ‘limited by shares’, which means they’re owned by shareholders who have certain rights. A shareholder is an individual who puts money into the company and receives a percentage of ownership of the company in the form of shares.

Companies ‘limited by guarantee’ have guarantors and a ‘guaranteed amount’ instead of shareholders and shares. This model is commonly opted for by for not-for-profits, as it provides personal financial protection. There are generally no profits distributed to guarantors. Instead, profits are reinvested into the company to help achieve its non-profit objectives.

7. Gather the required documentation

Both a ‘memorandum of association’ and ‘articles of association’ are required for a company formed in the UK under the Companies Act 2006.

Memorandum of association

A memorandum of association is a legal statement signed by all initial shareholders or guarantors who agree to form the company. If you register your limited company online, a memorandum of association will be created automatically. However, if you register by post you’ll need to use the government’s memorandum of association template to create one.

You can’t update the memorandum once the company has been registered.

Articles of association

You’ll also need ‘articles of association’, a governing constitutional document that includes information about how the company should be run. This information should be agreed by the shareholders or guarantors, directors and the company secretary.

There are two options for creating articles of association:

- Adopt default standard articles (‘model articles’ - prescribed by the Companies Act 2006).

- Write your own and upload or send when you register your company.

8. What records do you need to keep?

You must keep records about the company itself, along with financial and accounting records.

It can be beneficial to hire an accountant to help you with your tax, as HMRC, could check your records. Using accounting software can also help to keep your accounts in order, which will be incredibly helpful to both you and your accountant if the company receives an HMRC tax investigation.

Company records

You’ll need to keep records of the following:

- directors, shareholders and company secretaries

- results of shareholder votes and resolutions

- promises for the company to repay loans at a specific date and who they must be paid back to

- promises the company makes for payments if something goes wrong and the company is to blame

- transactions in which someone buys shares in the company

- loans or mortgages secured against the company’s assets

PSC register

It’s also necessary to keep a register of ‘people with significant control’ (PSC). The PSC register must include details of anyone who:

- has more than 25% shares or voting rights in your company

- can appoint or remove a majority of directors

- can influence or control your company or trust

- A PSC register is required even if you have no people in your company with significant control.

Accounting records

You’ll also need to keep on top of your accounting records, which should include:

- money received and spent by the company

- details of company-owned assets

- debts the company owes or is owed

- stock the company owns at the end of the financial year

- stocktakings you used to work out the stock figure

- all goods bought and sold, along with who you bought and sold them to and from (this doesn’t apply if you run a retail business)

The UK government provides further detail on financial records required for filing your annual accounts and Company Tax Return. Additional records include receipts, invoices and bank statements.

Two important points to remember:

- If you keep your records somewhere other than your company’s registered office address, you must tell Companies House.

- You can be fined £3,000 by HMRC or disqualified as a company director if you don’t keep accounting records.

9. Consider accounting software

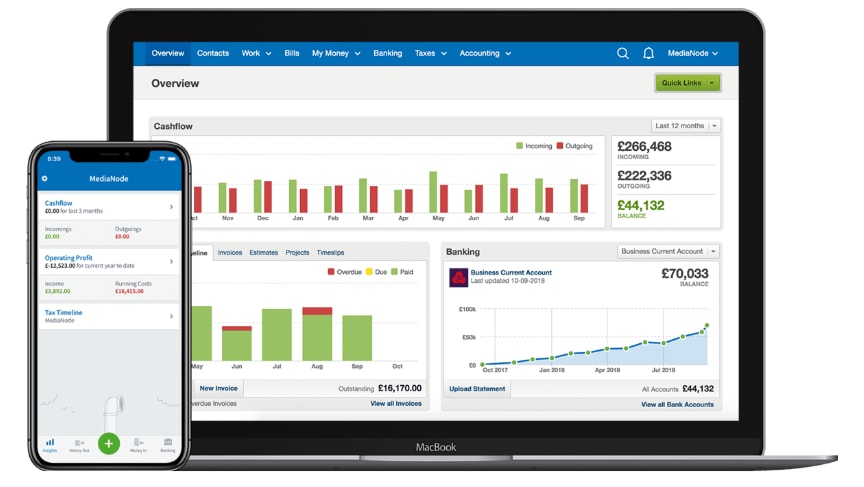

It wouldn’t be surprising to feel a little overwhelmed by the financial records you need to keep on top of once you’ve formed a limited company. In addition to hiring a professional, such as an accountant, it can be extremely helpful to use accounting software such as FreeAgent.

Making Tax Digital (MTD) for VAT is now in effect - businesses above the VAT threshold of £90,000 are required to store financial records digitally and submit VAT returns using MTD-compliant accounting software like FreeAgent. The software also enables you to keep track of all of your expense receipts, forecast your Corporation Tax bill and file your Self Assessment tax return directly to HMRC.

Why not give FreeAgent a try with a 30-day free trial?

10. Open a business bank account

Since a limited company is a separate legal entity from its directors and shareholders, the money has to be clearly separated from their personal finances.

There is no legal requirement to set up a business bank account for your limited company, however, it’s much easier to trade and manage your business if you have one. A director can withdraw salary, expenses and dividends from the company, for example, but other withdrawals from the company will be treated as a director’s loan.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.