What needs to be on a UK VAT invoice?

You must have a valid VAT invoice in order to charge VAT on sales or reclaim VAT charged on the goods or services you purchase.

What is a VAT invoice?

A VAT invoice is an invoice that includes all the information about VAT that HMRC requires. Only VAT-registered businesses are eligible to issue VAT invoices.

If your business is VAT-registered, in most cases you’ll need a full VAT invoice, but for some retail transactions a modified invoice or a simplified invoice should be used instead.

VAT invoice requirements

Full VAT invoices

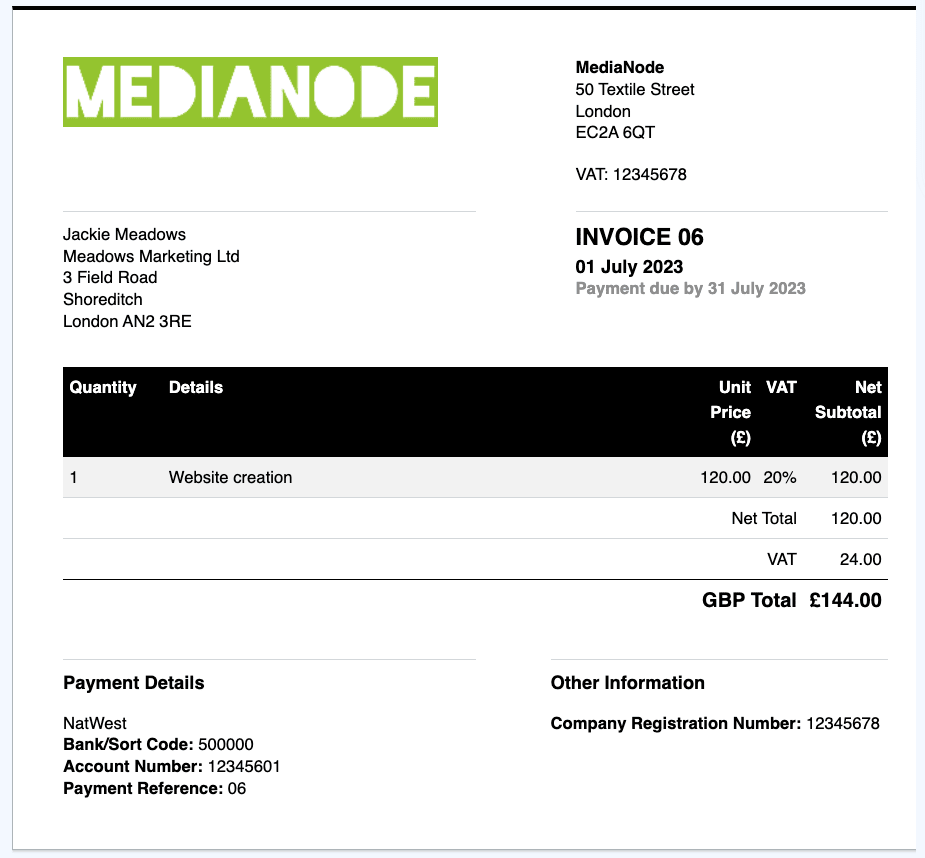

A full VAT invoice needs to show:

- the supplier's name, address and VAT registration number

- the name and address of the person to whom the goods are supplied

- a unique identification number (see below)

- the date of issue

- the time of supply of the goods or services (this may be the same as the date of issue)

- a description of the goods or services supplied, including the quantity of each type of item

- the total amount, excluding VAT

- the total amount of VAT

- the price per item, excluding VAT

- the rate of VAT charged per item (if an item is exempt from VAT or is zero-rated, this should be clearly stated)

- the rate of any discount per item

Modified VAT invoices

A modified VAT invoice should be used for retail supplies that total over £250. It must include all the same information as a full VAT invoice, but should also include the total amount including VAT.

Simplified VAT invoices

A simplified VAT invoice can be used for retail supplies that total under £250. It only needs to show:

- the supplier's name, address and VAT registration number

- a unique identification number

- the time of supply of the goods or services (this may be the same as the date of issue)

- a description of the goods or services supplied

- the rate of VAT charged per item (if an item is exempt from VAT or is zero-rated, this should be stated)

- the total amount including VAT

VAT invoices in FreeAgent

FreeAgent’s customisable invoice templates include all the VAT information HMRC needs, so you'll never need to worry about your invoices meeting legal requirements again.

Find out more about how FreeAgent makes invoicing a breeze.

Common VAT invoicing questions

What is a unique identification number?

Each of your VAT invoices must have a unique and sequential number. If you restart your invoice numbering each year, this could lead to identically numbered invoices in different years.

You can use separate invoice sequences for different customers as long as each sequence of invoices is separate and unique. Customer prefixes can also be used on the invoices, but no two customers should have the same prefix.

What about foreign currencies?

For invoices showing transactions in foreign currencies, you must always:

- show the total VAT that is payable in sterling on your invoice (if the supply takes place within the UK)

- keep an English translation of any invoice written in a foreign language, and provide it within 30 days if asked to do so by HMRC

When you convert the total payable VAT from a foreign currency into sterling on your invoice, you must use one of the following methods:

- the UK market selling rate at the time of supply

- HMRC’s period rates of exchange

In some cases, you may also apply to HMRC to use a different method of accounting for VAT for invoices showing transactions in foreign currencies. If you wish to use a different method of accounting for VAT, you should contact HMRC directly.

For help adding or removing VAT from prices, you can check out our handy VAT calculator.

Disclaimer:The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.