Charging and reclaiming VAT

If your business is registered for VAT and you know what rate applies to your goods or services, you’re ready to start charging VAT.

Charging output VAT to your customers

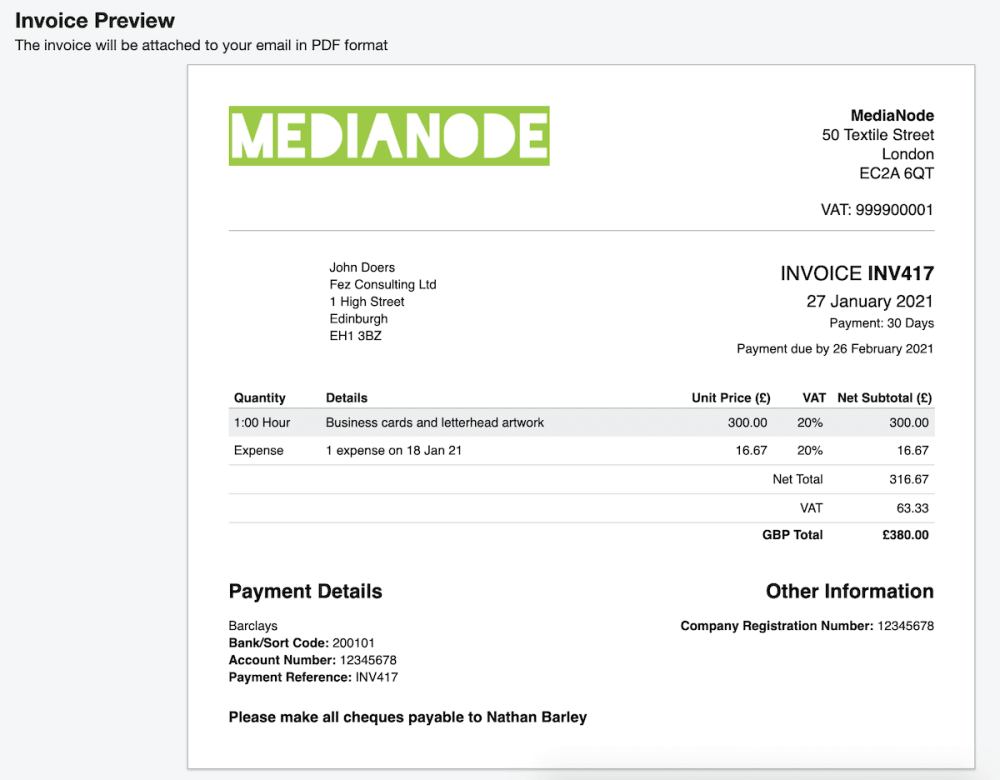

The VAT you charge to your customers is called output VAT. When your business is registered for VAT, you need to add VAT to each VATable item on each of your sales invoices. VATable items are any goods or services that are subject to VAT at the standard, reduced or zero rate.

The rate of VAT you apply to each item is the rate that HMRC stipulates that you need to charge for that item. For example, if a business sells baby equipment and sells a carrycot and a babygrow, the carrycot would be charged at 5% and the babygrow at 0%, because the chargeable VAT for each of these items is different.

HMRC refers to all sales invoices that contain VAT as ‘VAT invoices’. Take a look at our guide on the rules for what must be shown on a VAT invoice to find out more.

Charging VAT to your customers in FreeAgent

If you’re using FreeAgent, you can choose from a gallery of invoice templates that include all the VAT information that HMRC requires. Just pick the relevant VAT rate when you add items to your invoices and FreeAgent will do the rest.

Find out more about VAT in FreeAgent.

Claiming back VAT on your purchases

Now you know how to charge output VAT to your customers, what about the VAT you can see on the bills that your suppliers give you? If your business is registered for VAT, you may be able to claim back the VAT from HMRC as input VAT.

When can you not claim back VAT on purchases?

There are some types of costs on which reclaiming VAT is not allowed. A classic example is business entertaining. If you take non-employees (for example, current or prospective customers) out for a meal, the restaurant will charge you VAT - but HMRC says you can’t claim that VAT back as input VAT. You simply have to take the full cost on the chin.

If a supplier doesn’t give you a valid VAT invoice, then in most cases you can’t claim the VAT back. There are some exceptions (for example, if you only get a till receipt with the supplier’s VAT number on it, you can claim back VAT for VATable items), but don’t try to claim back VAT on any invoices or receipts that you think may not be valid. If you get a visit from a tax inspector they’ll check the bills your suppliers have given you, so if you’re in any doubt be sure to check with an accountant before claiming.

If a bill has no VAT on it (if your supplier isn’t registered for VAT and therefore didn’t charge you VAT, for example) or if the bill relates to VAT-exempt goods or services, you won’t be able to claim any VAT back.

The VAT Flat Rate Scheme also works differently. You don’t reclaim input VAT except on large capital assets. You can find out more in our guide to using the Flat Rate Scheme.

What if your business isn’t registered for VAT?

If your business isn’t registered for VAT, then you can’t charge VAT to your customers - but this also means that you can’t claim any VAT back.

You have to register your business for VAT if its annual taxable sales are above the VAT registration limit. In some cases you may wish to register before you reach the threshold, in order to claim back VAT on costs, for example. However, remember that if your business’s current and prospective customers are the general public, you may decide not to register for VAT until you have to, because if you charge VAT to a customer who isn’t registered for VAT, they can’t claim it back. This customer might feel your prices have increased.

For example, a VAT-registered gardener who charges £70 for a full day’s work would apply the standard rate of 20% VAT to the corresponding invoice. This means that the gardener’s customers who are members of the public - and therefore not registered for VAT - would have to pay £84 (£70 x 1.2 = £84) instead of £70 for a full day’s work. As a result, this gardener may struggle to win business against a competitor who isn’t registered for VAT.

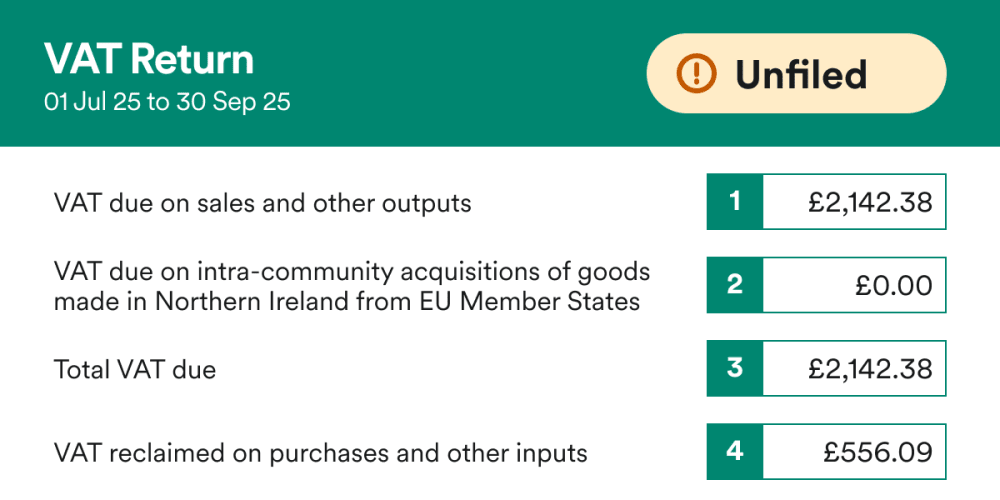

Reclaiming VAT in FreeAgent

Reclaiming VAT can be complicated, but FreeAgent can help simplify the process. Using the relevant information from the bills, expenses and bank transactions that you enter as you run your business, FreeAgent automatically generates your VAT return ready for submission to HMRC.

Take a closer look at how FreeAgent makes VAT as easy as 1,2,3.

Disclaimer:The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.