Manage your property finances and tax with FreeAgent for Landlords

Earning income from property? Take a load off your day-to-day admin and get cashflow clarity with our intuitive accounting software.

Accountant or bookkeeper? Find out more.

Understand your tax obligations

FreeAgent keeps you on track by auto-populating much of your Self Assessment throughout the year. Then, when you're ready, you can submit your tax return directly to HMRC.

Try FreeAgent for freeEasy-to-use accounting software to let you get on with letting

Designed to help you effortlessly manage your property finances and admin anywhere, anytime.

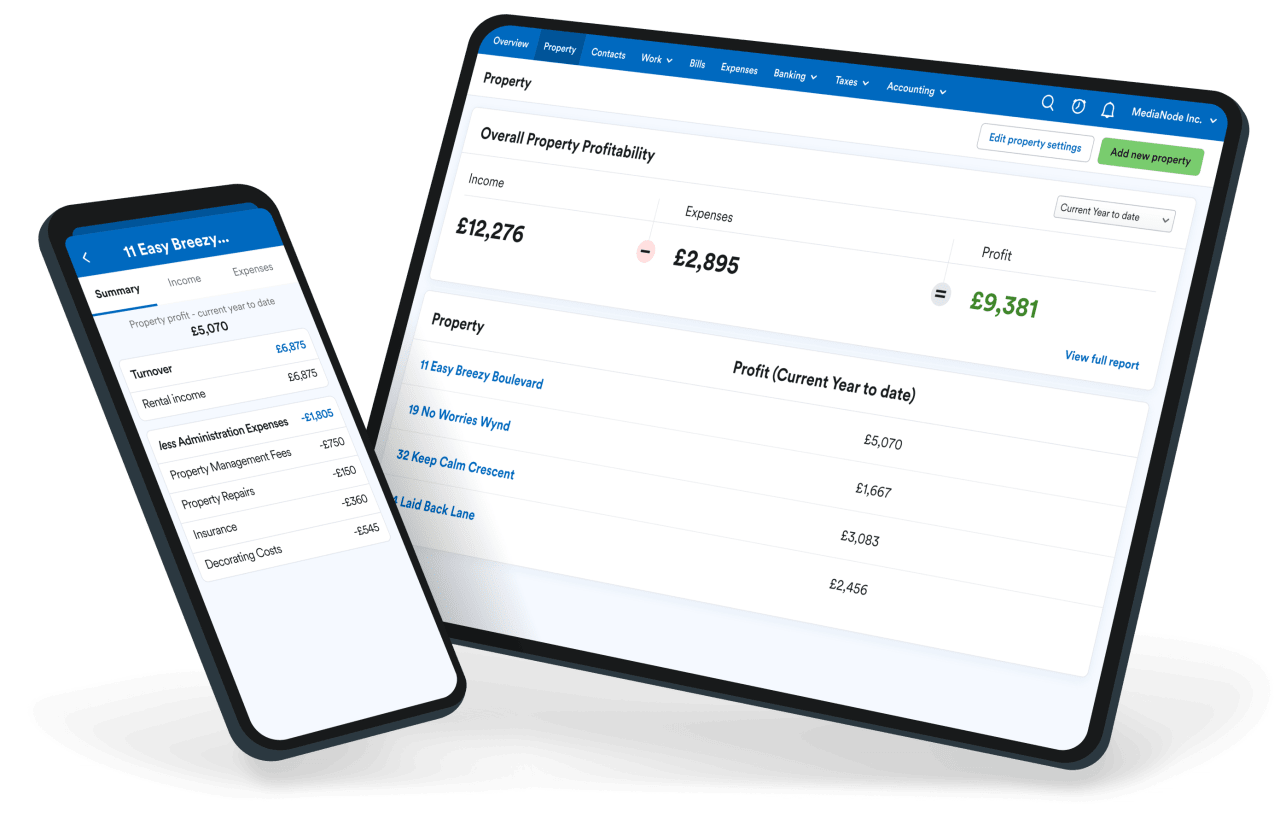

Get the full financial picture

Easily record and monitor all of your income and costs in real time, as well as view your overall property profitability.

Automate your rental admin

Built-in functionality helps you to automate the process of recording and reconciling rental income, and manage costs.

Rely on stellar UK-based support

Our award-winning support accountants are all experts waiting in the wings to help if you need it.

Manage your finances on the go

Record rental income, bills and out-of-pocket expenses in a few taps with the FreeAgent mobile app.

I would definitely recommend FreeAgent to other landlords.

Everything you need to know about managing your property finances

Whether you're letting your first property or have an established portfolio, FreeAgent can help you build up your landlord expertise with helpful guides and keep you posted on the latest news.

Browse our resourcesSimple pricing plans made for landlords

No hidden costs, cancel at any time. Making Tax Digital-compatible.

Billed monthly

50% off for your first six months

All prices excl. 20% VAT

Optional add-ons

Unlimited receipt and bill captures

Unlock unlimited use of the Smart Capture tool, which offers automatic data extraction, transaction matching and categorisation for receipt and bill images and files. Ideal for anyone who processes more than 10 files a month. (Price excl. 20% VAT).

Billed annually

50% off for your first year

All prices excl. 20% VAT

Optional add-ons

Unlimited receipt and bill captures

Unlock unlimited use of the Smart Capture tool, which offers automatic data extraction, transaction matching and categorisation for receipt and bill images and files. Ideal for anyone who processes more than 10 files a month. (Price excl. 20% VAT).

Free

If you have a business current account with NatWest, Royal Bank of Scotland, Ulster Bank, for as long as you retain the account - or have a Mettle bank account and make at least one transaction a month. Optional add-ons may be chargeable.

Optional add-ons

Unlimited receipt and bill captures

Unlock unlimited use of the Smart Capture tool, which offers automatic data extraction, transaction matching and categorisation for receipt and bill images and files. Ideal for anyone who processes more than 10 files a month. (Price excl. 20% VAT).

What's included in your FreeAgent subscription?

Nail the daily admin

| Dashboard | See the big picture for your business including cashflow, profit and loss, invoice and tax timelines. |

|---|---|

| Mobile app | Nail your admin on the go. Record expenses, track time, manage invoices and more. |

| Radar | Get unique insights into your business performance with tailored trend-spotting and tips. |

| Invoicing | Get paid faster with smart invoicing tools. Create automated invoices and reminders and set up easy online payments. |

| Estimates | Create and send professional estimates from templates and convert them to invoices in a click. |

| Expenses | Track costs quickly and easily. Snap receipts and record out-of-pocket expenses on the go. |

| Smart Capture1 | Process receipts and bills faster with automatic data extraction, transaction matching and categorisation. |

| Projects | Check project income, expenses and profitability, and manage complex projects with ease. |

| Time tracking | Track the time you spend on projects, add this to invoices and generate timesheet reports. |

| UK-based support | Speak to our UK-based support accountants online or over the phone if you ever need help. |

| Property finances | Record your income and costs against each property and track profitability. |

Relax about tax

| VAT | Generate MTD-compatible VAT returns automatically and file them directly to HMRC in minutes. |

|---|---|

| Self Assessment | Get a real-time view of how much you owe for your tax return and file it directly to HMRC. |

| Tax Timeline | Get a real-time view of your tax calculation including what you owe and when it’s due. |

Manage your finances

| Banking | Track your finances with ease and accuracy by setting up a bank feed to automatically import your business transactions. |

|---|---|

| Smart categorisation | Save time with smart categorisation which automatically explains new transactions based on previous descriptions. |

| Cashflow | Track your incomings and outgoings and see what’s ahead with the Cashflow forecast. |

| One-click payments | Make it easier for your customers to pay you with payment solutions from Tyl by NatWest, Stripe, GoCardless and PayPal. |

Optional add-ons

All prices excl. 20% VAT

| Smart Capture Unlimited1 | £5/month. Billed monthly. |

|---|

All businesses can use Smart Capture to process up to 10 receipts and bills per month as standard. The Smart Capture Unlimited add-on enables unlimited use of the feature. You can purchase the add-on for £5 (+ VAT) per month from within your FreeAgent account once you’ve subscribed. Find out more about Smart Capture.

Frequently asked questions

Who is FreeAgent for Landlords for?

Designed specifically for individuals who earn income from property, FreeAgent for Landlords is for landlords who earn income from properties but do not treat their property rentals as limited companies for tax purposes i.e. are unincorporated landlords.

Can I use FreeAgent for Landlords with an accountant?

Yes, FreeAgent for Landlords is built for landlords and their accountants, and we’ve made it easy for you to use the software to work with an accountant or bookkeeper if you choose to do so.

If you don’t have an accountant at the moment and you’re interested in finding one, take a look at our comprehensive directory of accredited FreeAgent accountants.

Does FreeAgent for Landlords support Self Assessment?

FreeAgent for Landlords will auto-populate the UK Property (SA105) pages of the Self Assessment form where possible and allow you to submit the return directly to HMRC from the software.

If you have other (non-property) income to include, such as income from self-employment, you will be able to enter this manually in FreeAgent for Landlords and include it with your Self Assessment submission. However, please note that if you choose to submit your return to HMRC through FreeAgent for Landlords, you will not be able to submit any additional details via an alternative provider, as you can only make one Self Assessment submission.

If you use a separate sole trader or limited company FreeAgent account to record your other income, you can only make a submission from one version of the software. For example, if you choose to submit from a sole trader FreeAgent account, your Self Employment pages will be auto-populated where possible, but you will have to manually enter the figures for the Property pages (which you can obtain from your FreeAgent for Landlords account).

Conversely, if you choose to submit from a FreeAgent for Landlords account, the Property pages will be auto-populated where possible, but you will have to manually enter the figures for the Self Employment pages (which you can obtain from your sole trader FreeAgent account).