Year one of MTD for Income Tax: a step-by-step guide

This is what Making Tax Digital will actually look like for sole traders and landlords.

FreeAgent's Director of Product shares our plans and goals for a transformative year.

This is what Making Tax Digital will actually look like for sole traders and landlords.

Here’s how to lead tough conversations and transition your clients to a digital-first world with conf...

In the meantime, feel free to browse for more handy content and useful ideas.

Improving long-term visibility into cashflow is a step towards more confident decisions. Here are thr...

If you sell on eBay, Vinted or Etsy, when do you have to start paying tax?

What does the first year of MTD for Income Tax have in store for practices? We’ve pulled together all...

If you’ve been contacted about Making Tax Digital - don’t panic! Here’s what you need to do.

We’re excited to announce that FreeAgent now integrates with Fathom. This new integration helps busin...

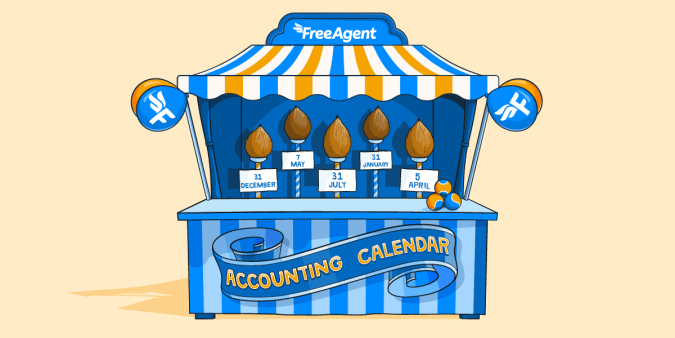

Roll up, roll up! It’s time to get this year’s important tax deadlines in the diary with our free dow...

Here are the numbers you need to plan for a profitable 2026.

We’ve put together some useful tips that should help you stay cool as a cucumber all the way to 31st ...

From office parties to festive gifts, here are the expenses your business could be claiming tax relie...

Brilliant gifts for independent shoppers who want to support small businesses.

We’ve rolled out updates in FreeAgent to improve your compliance workflow.

Our essential Budget run-down for small businesses - including updates on taxes, pensions and wages.

FreeAgent now integrates with Pleo, a user-friendly expense management solution designed for business...

These accessibility hacks will help your business welcome a growing market with money to spend.

Here are 6 ways to communicate effectively with landlord clients to ensure they're prepared ahead of ...

Digital demons, phantom clients, monster bills: real-life stories of vanquished business horrors.

A successful attack can inflict immediate and significant harm - here’s how to strengthen your defences.

FreeAgent reveals huge numbers of businesses hit by late payment crisis.

Lessons from author, presenter and time management expert Suzanne Mulholland.

You can now use FreeAgent to make MTD for Income Tax submissions on behalf of your qualifying sole tr...

Questions to ask in a post-Covid age of remote and hybrid work.

FreeAgent’s Chief Accountant answers our customers' big questions about MTD for Income Tax.

Hospitals, cafes and film sets: small businesses are proving you can do your accounts anywhere.

Continuing Professional Development (CPD) is important for your accounting or bookkeeping career. Her...

Discover the the rich mix of insights we've uncovered from our MTD consultations.

Why is a positive company culture important to every business… and how can you nurture one?

We’re excited to announce that FreeAgent now supports CIS for Contractors - helping you to stay organ...