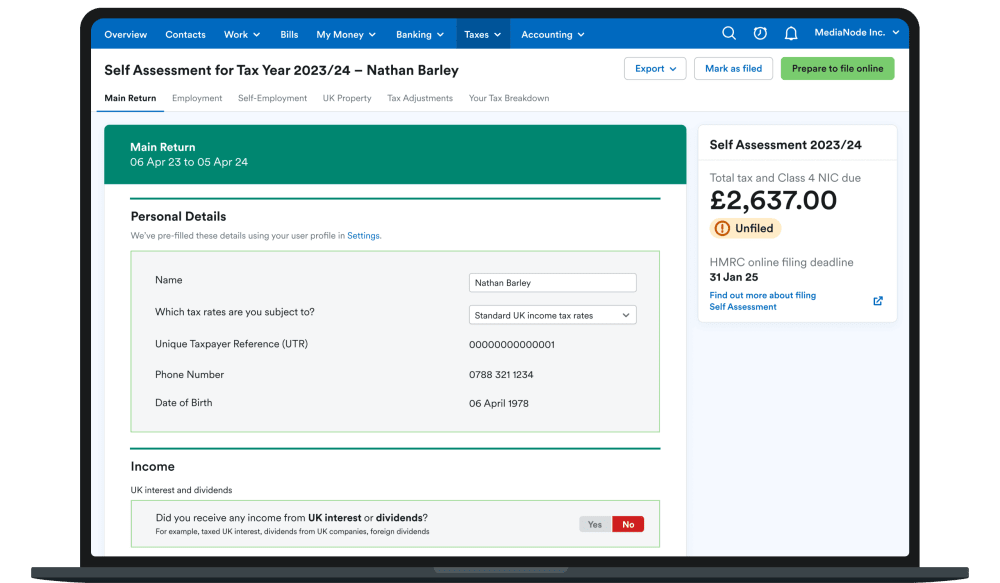

5 reasons to be a Self Assessment early bird

While the deadline for filing your Self Assessment is still a little way off on 31st January, there are compelling reasons to take this task off your plate early - and we’ve got five of them right here! You might be tempted to file your tax return at the last minute, especially if work is feeling non-stop, but this might not be the best option for you or your business. Remember, filing your tax return early doesn’t change the payment date.

Here’s why you should consider filing early.

1. Reduce your stress levels

Running your own business is fantastic - but can also be stressful. In our latest Small Business Monitor survey in May 2024, a fifth of the business owners we spoke to told us their work has a negative impact on their mental wellbeing. Clearing chunky, stressful tasks - like filing your tax return - off your list can be a huge help. It might sometimes be a slog to reach that finish line (though it doesn’t have to be with FreeAgent’s help), but it’ll feel so worth it when you can breathe a sigh of relief for another year.

2. Make fewer errors

If you’re scrabbling to get your tax return together just before the 31st January deadline, you’re probably going to end up with more miscalculations and typos than if you were preparing it well ahead of time. In a year when the Chancellor has promised to “crack down on tax avoidance and tax evasion” and is recruiting additional HMRC compliance officers, it’s especially wise to triple-check your numbers for mistakes. Of course, if you do realise you’ve made a mistake before the deadline, there are ways to fix a Self Assessment return after filing it.

3. Get better cashflow insights

Getting your books ready, preparing and filing your tax return means that you’ll know exactly how much tax you’re liable for - and you can budget accordingly. If you wait until close to the 31st January deadline, you risk finding out you have a larger bill than anticipated and not enough money in the bank. Filing your tax return in good time is a healthy cashflow habit to form, if you haven’t already.

4. Avoid a fine

Did you know that if you file your Self Assessment tax return late, you’re liable for a fine? It’s £100 for anything up to three months late, with further penalties for any returns filed later than that. On top of this, you will also be charged interest on late payments. This rate is currently set at 7.5% by HMRC.

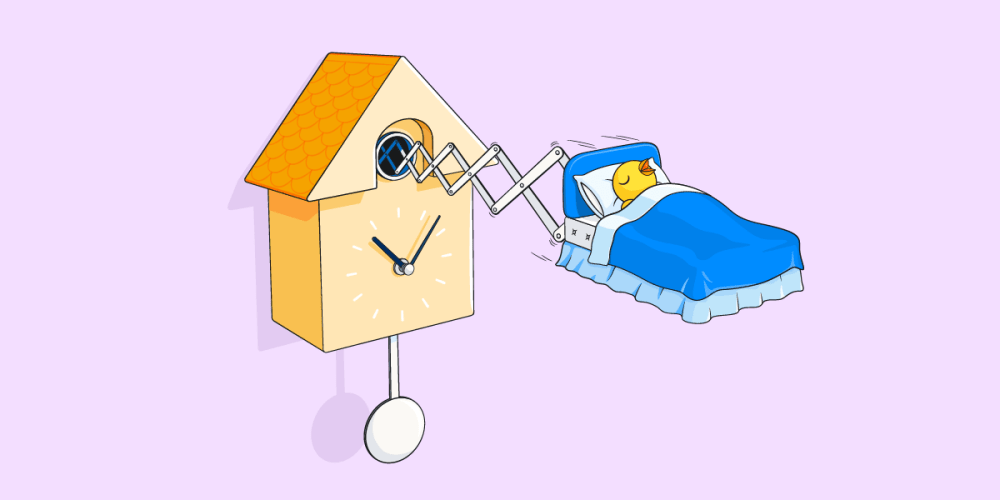

5. Free up your time over the festive season

There’s nothing worse than being overburdened with work over the holidays - particularly if you’d rather be celebrating. While you might still be relatively busy with work over this period, one thing you can clear up in advance is tax admin. Check it off your list now and focus on where the next mince pie is coming from instead.

First-time filer?

If you’re filing your tax return for the first time, it’s worth noting that it can take up to 10 days after HMRC registration to receive the codes you need to file, so make sure to set some extra time aside for this.

Ready to soar through Self Assessment? FreeAgent is the only accounting software that lets small businesses and accountants file directly to HMRC. Get your 30-day free trial and save your business time on tax returns and everyday admin chores.

Originally published

Last updated

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.