Would you be better off on the VAT Flat Rate Scheme?

Wonder if you’d be better off on the Flat Rate Scheme? Here’s an introduction to the UK’s VAT Flat Rate Scheme for small businesses.

What is the VAT Flat Rate Scheme and how does it work?

If you use the Flat Rate Scheme, you charge VAT to your customers (‘output VAT’) and pay VAT to your suppliers when you buy goods or services from them (‘input VAT’) in the normal way.

But when it comes to preparing your VAT return and paying VAT to HMRC you do things slightly differently. Instead of adding up all the VAT you charge and taking away the VAT you can reclaim, you add up all your sales - including any VAT you charged to your customers - and pay a percentage of those sales to HMRC. The percentage you pay depends on what your business’s trade is, unless you’re a limited cost trader.

Types of sales to include

You need to include any standard-rated, reduced-rated, zero-rated and exempt sales you make in your VAT return. However, you may leave out any sales that are outside the scope of VAT.

Claiming back VAT on the Flat Rate Scheme

With the Flat Rate Scheme, you can’t claim back any of the VAT you made on purchases, unless you buy a capital asset that cost £2,000 or more including VAT.

Percentages of sales on the VAT Flat Rate Scheme

On the Flat Rate Scheme, you pay a percentage of your total sales to HMRC when filing your VAT return. HMRC has set percentages depending on what your business does.

During the first year that your business is registered for VAT (which is not necessarily the same as the first year you’re on the VAT Flat Rate Scheme), you get a 1% discount on the percentages - so you would use, for example, 10% instead of 11% if you run an advertising business.

Important: if you’re a limited cost trader, you have to use 16.5% instead of your trade’s percentage!

Businesses making more than one kind of sale

If your business fits into more than one category because you make different kinds of sales, you’d choose the percentage that applies to the majority of your sales and apply that to your total sales.

VAT Flat Rate Scheme eligibility

If you’re interested in joining the VAT Flat Rate Scheme, you can apply to HMRC provided your business meets certain criteria.

Your total estimated VATable sales for the next year must be under £150,000 – this includes everything you plan to sell that is subject to VAT.

Once you join the scheme you can keep using it until your total business income goes above £230,000 a year.

You will be ineligible to join the VAT Flat Rate Scheme if:

- you’ve been in the scheme before and left it less than 12 months ago (you need to wait until a year has gone by before you can rejoin)

- you’ve been guilty of a VAT offence or charged a penalty for evading VAT within the last 12 months

- you use a second-hand margin scheme

- you are, or have been within the last 24 months, a member or potential member of a VAT group, or registered for VAT as a division of a larger business

- your business is closely associated with another business

Benefits of the VAT Flat Rate Scheme

HMRC says the Flat Rate Scheme makes your record-keeping simpler because you don’t have to work out what VAT you can claim on your purchases.

The Flat Rate Scheme can also save you money, though it’s not designed with this in mind. This tends to depend on what sector you’re in, and how much VAT you pay out on your costs. Check out our VAT Flat Rate Scheme calculator to find out if your business is a good fit.

When to consider avoiding the VAT Flat Rate Scheme

Because flat rate taxable sales include VAT-exempt sales, it’s probably not a good idea to join the scheme if you make a lot of exempt sales, as you might end up paying more in VAT.

If you make a lot of zero-rated sales or if you buy a lot of standard-rated goods and services, joining the scheme is also likely to cost you more in VAT. Businesses not on the Flat Rate Scheme would normally get a repayment from HMRC each quarter which they would lose if they joined the scheme.

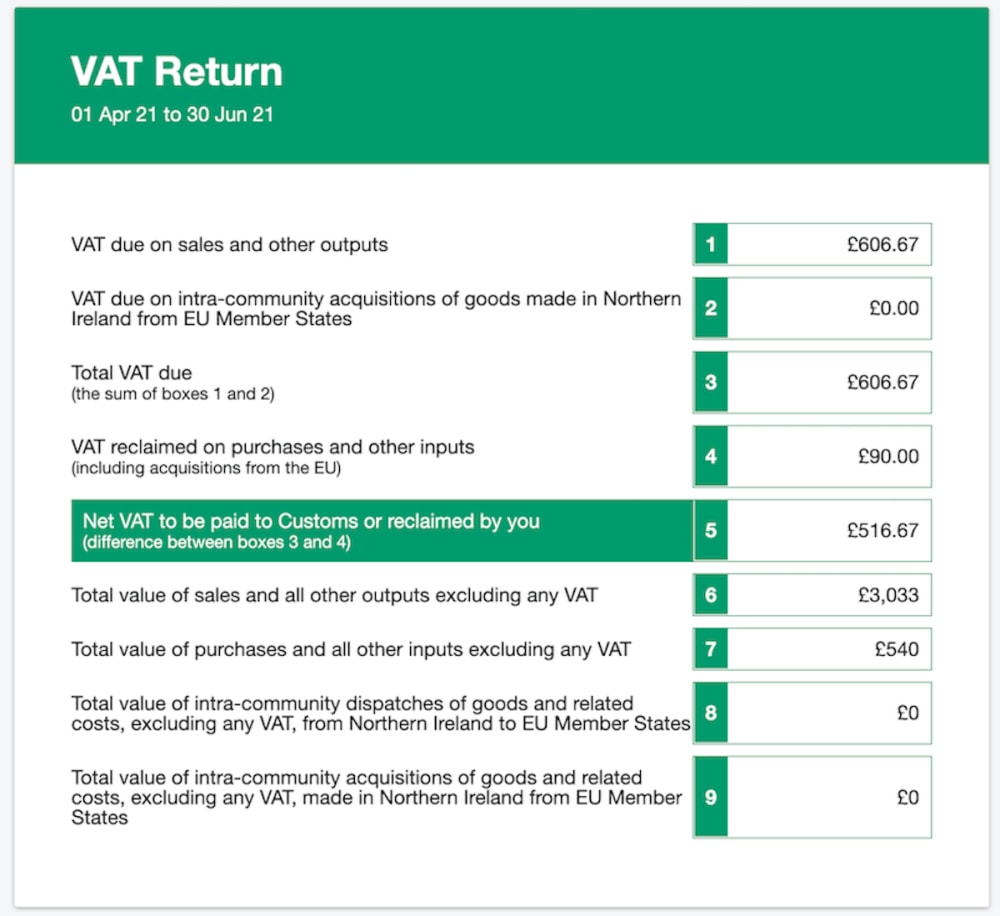

Getting your VAT returns right when you’re using the VAT Flat Rate Scheme

FreeAgent’s VAT functionality includes support for the VAT Flat Rate Scheme. From the data you enter in your books day-to-day, FreeAgent calculates all the numbers you need and automatically populates your VAT return ready to file directly to HMRC in a few clicks.

Find out more about online VAT filing in FreeAgent.

Disclaimer:The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.