What's next for MTD for Income Tax? Key takeaways from our government and industry panel

An expert panel from the government and the accounting world discussed next steps to MTD success.

Find out everything you need to know about Making Tax Digital, including whether the legislation applies to you, key deadlines and what you need to do to comply.

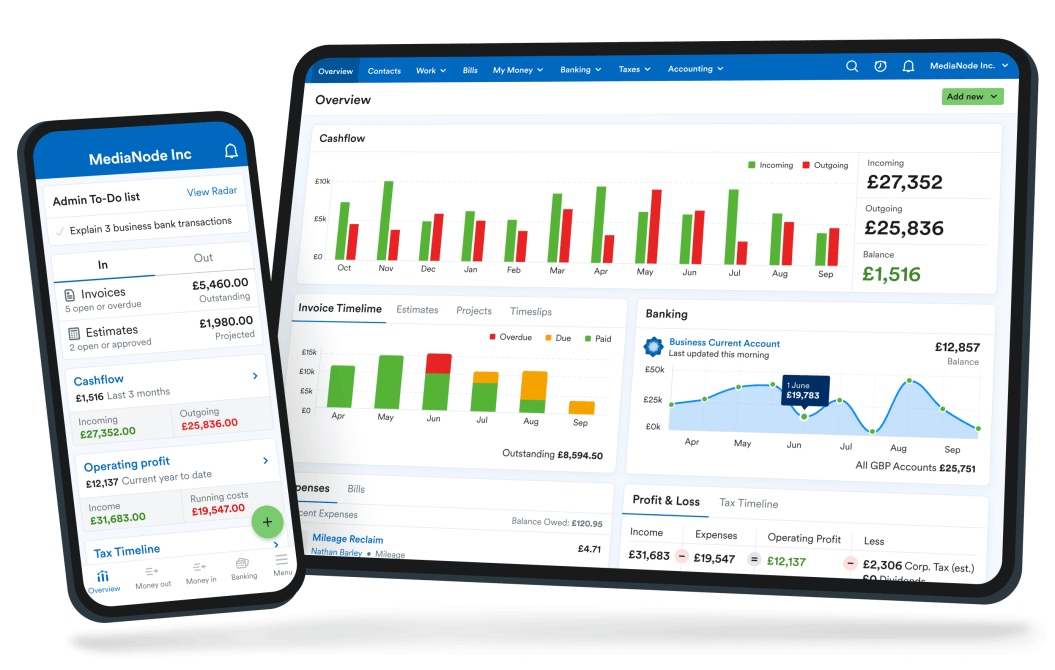

How FreeAgent can help

Accountant or bookkeeper? Visit our Making Tax Digital information hub for a range of resources.

Making Tax Digital (MTD) is the government's initiative to implement a fully digital tax system in the UK, whereby taxpayers keep digital records and use MTD-compatible software to make tax submissions electronically.

MTD for VAT applies to all VAT-registered businesses

MTD for Income Tax will apply to most self-employed individuals and landlords with qualifying income over £50,000

MTD for Income Tax will apply to most self-employed individuals and landlords with qualifying income over £30,000

MTD for Income Tax will apply to most self-employed individuals and landlords with qualifying income over £20,000

To comply with Making Tax Digital legislation, you need to use MTD-compatible software to keep digital records and make submissions to HMRC electronically.

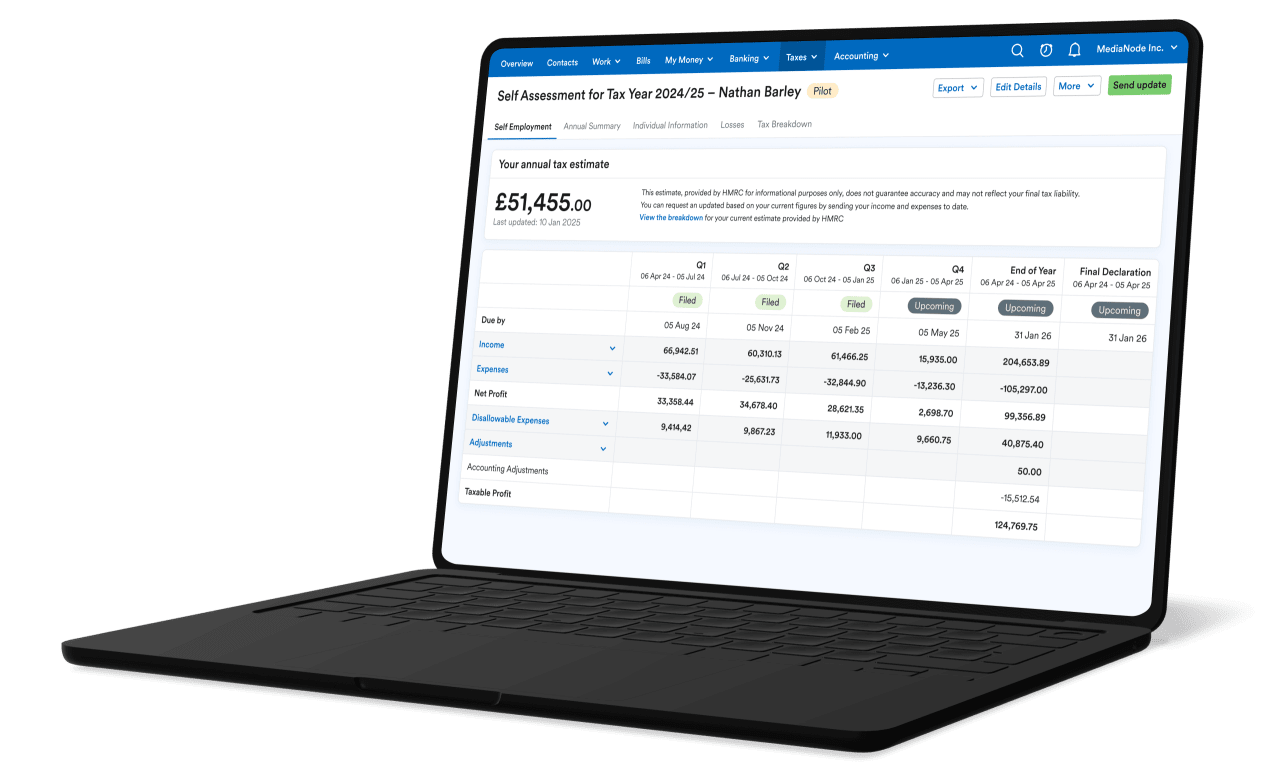

Making Tax Digital for Income Tax, previously known as 'MTD for Income Tax Self Assessment' or 'MTD for ITSA', will replace the current system of annual Self Assessment tax returns. MTD for Income Tax will come into effect in April 2026 for self-employed individuals and landlords with income of more than £50,000, in April 2027 for those with income over £30,000, and by 2029 at the latest for those with income over £20,000.

FreeAgent is on HMRC's list of compatible software for MTD for Income Tax for businesses. This means that if you're a business owner, you'll be able to use FreeAgent to follow the rules of MTD for Income Tax and make the required tax submissions.

FreeAgent is jargon-free, easy to use and MTD-compatible. Go solo or work with an accountant or bookkeeper for total peace of mind.

Try FreeAgentMTD for VAT requires all VAT-registered businesses to keep digital records and use MTD-compatible software to submit VAT returns electronically.

FreeAgent's MTD-compatible accounting software allows you to submit MTD VAT returns directly to HMRC. Just follow these simple steps.

Register for Making Tax Digital for VAT on HMRC's website and sign up to FreeAgent.

Connect your FreeAgent account to HMRC's Making Tax Digital service.

Get your business’s accounts ready and file your first MTD VAT return.

FreeAgent is jargon-free, easy to use and MTD-compatible. Go solo or work with an accountant or bookkeeper for total peace of mind.

Try FreeAgentRead more about Making Tax Digital on our blog

An expert panel from the government and the accounting world discussed next steps to MTD success.

Discover how FreeAgent for Landlords simplifies property finances, supports MTD for Income Tax, and h...

Emily Coltman FCA

Chief Accountant at FreeAgent

Accountant or bookkeeper? Visit our Making Tax Digital information hub for a range of resources.

FreeAgent's powerful automation features can help get your accounts in order for digital filing with minimal hassle. Check out all the other ways FreeAgent can help you stay on top of your business finances.

Try for freeAccountants and bookkeepers, join our free Partner Programme and access exclusive discounts for your clients.