Mileage and motor expenses: what you need to know

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

If you drive a vehicle to travel for business, you might be able to claim back some of the costs you incur as tax relief. How you go about doing this can be complicated, so here’s a guide to help you work out what you can and can’t claim for.

Depending on your business and what you use the vehicle for, you may be able to claim for some of the expenses you incur as tax relief. When claiming for motor expenses, there are different rules for:

- sole traders and partners in a partnership

- employees of limited companies (including directors)

If you’re a sole trader or partner

When you’re a sole trader or a partner in a non-limited-liability partnership, legally there’s no difference between you and your business, so for you there’s no such thing as a ‘company car’. Despite this, you may be able to claim for some motor expenses when you come to file your Self Assessment tax return for the tax year.

The expenses you can claim for differ depending on whether you own the car or have hired it.

Your own car: business vs. private use

When you own the car, you’re likely to use it for both business and private purposes. For example, you might use it mainly to travel to visit clients, but you might also use it for your weekly food shop. This means that you may need to keep a record of:

- the total cost of running your vehicle

- the total miles, both business and personal, that you travel in your vehicle

- the number of miles you travel in your vehicle that are purely for business

What information you need to keep track of will depend on whether you use what we call the ‘simplified’ method or ‘full-cost’ method of recording your motor expenses. We’ll talk in more detail about each of these later, but the table below outlines what information you’ll need to keep track of for each method:

| Information you’ll need | Required for the ‘simplified' method? | Required for the ‘full-cost' method? |

|---|---|---|

| The total cost of running your vehicle | No | Yes |

| The total miles, both business and personal, that you travel in your vehicle | No | Yes |

| The number of miles you travel in your vehicle that are purely for business | Yes | Yes |

HMRC is unlikely to accept that a vehicle is solely for business use unless it’s something like a taxi, or a van with your logo on the side. Even then, HMRC has the right to ask to see your mileage log to prove you use the vehicle exclusively for business purposes. Check the rules for travel as set out in HMRC’s Business Income Manual and speak to an accountant if you’re in any doubt about what does or doesn’t qualify as a business purpose.

Hire cars

If you hire a car for a business journey only, you can usually claim for the full cost of hiring the car as a business expense. If you hire a car for a mix of business and non-business travel, check the rules for travel as set out in HMRC’s Business Income Manual.

If you’re an employee (including limited company directors)

If you’re an employee of a company (including if you’re a director of the company), there are different rules depending on whether the car is your own or belongs to the company:

Employees using their own car

If you’re an employee of a company and use your own car for business purposes, you can sometimes claim the cost of a journey back from your employer, so this should be your first port of call. This is nearly always done by claiming a certain amount per mile.

If your employer doesn’t pay for motor expenses - or if they pay you back less than the mileage rates set by HMRC - you may be able to reclaim some of the cost from HMRC in the form of tax relief.

Claiming for mileage from HMRC

If you have to file a Self Assessment tax return, you can claim for this in the ‘Expenses’ section when you file your return. If you don’t have to file a tax return, you may be able to claim tax relief on the cost by making a claim to HMRC using form P87.

If you use a company car for private use (including commuting to work), it’s important to remember that HMRC is likely to see this as a taxable benefit. Speak to an accountant if you’re unsure about what you need to declare as a taxable benefit.

Employees using a company car

If the car is owned by the company, and an employee (including a director) uses the car for business purposes, the company may wish to reimburse the employee for any fuel costs incurred.

In this situation the company should reimburse the employee using HMRC’s advisory fuel rates for company cars. These are different from the mileage rates set by HMRC for travel in your own car. Please speak with an accountant if you’re in any doubt about what you should be reimbursing employees.

If the employee has a VAT receipt for the fuel that they purchased, the company can reclaim this (if they’re VAT registered).

How to claim: the ‘simplified’ and ‘full-cost’ methods

There are two ways to record mileage and motor expenses in your accounts. We call these the ‘simplified’ method and the ‘full-cost’ method. If you’re not sure which method is best for your business, you should consult with an accountant who will be able to advise you.

The ‘simplified’ method

The ‘simplified expenses’ method for different types of vehicles enables you to add up your business mileage and apply an HMRC-approved rate, then include that figure in your business accounts. Employees of limited companies travelling in their own cars would also use this method to work out how much mileage the company can reimburse them for. If the car is owned by the company, then the company would typically pay for and include all the costs of running it, using the ‘full-cost’ method as below.

If you’re planning to use this method to record your mileage, there are a couple of key things to watch out for:

- The mileage rate set by HMRC covers all the costs for owning and running the car, so you can’t claim anything else for the costs of servicing, repairs, MOTs or general wear and tear.

- You can’t switch between the ‘simplified expenses’ method and the ‘full-cost’ method (see below) unless you change vehicles.

Our mileage calculator can help you calculate your costs using the ‘simplified expenses’ method.

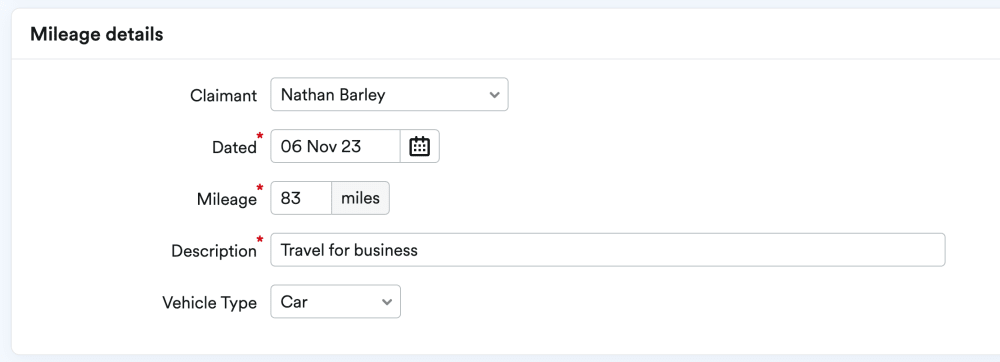

How to record mileage using the ‘simplified expenses’ method in FreeAgent

If you’re a FreeAgent user, you can easily add a new mileage claim by inputting the relevant details from your business journey. If there is a journey you make regularly, you can set it up to recur automatically, saving you from having to enter the details every time you make the journey.

The ‘full-cost’ method

If you can’t (or don’t want to) use the ‘simplified expenses’ method to claim for your motor expenses, then you’ll have to use the ‘full-cost’ method.

To do this, you’ll need to add up everything you’ve spent on the car during the year, including (but not limited to):

- fuel such as petrol or electricity

- MOTs and repairs

- vehicle tax

Once you’ve worked out your total costs for the year, you’ll then work out the business proportion of that. This will depend on how much you use the car for business journeys and how much you use it for personal journeys.

You may also be able to claim for capital allowances on the business proportion of the initial cost of the car.

In order to work out the business proportion you need to keep a mileage log. This means making a note of all the journeys (business and personal) you travel in the vehicle, including:

- the date of the journey

- the car’s mileometer reading at the start and end of the journey

- the distance travelled (to calculate this, subtract the start reading from the end reading)

- whether the journey was for business or private purposes

- if the journey was for business, what it was for

When you come to prepare your business’s accounts you can:

- add up all the business miles, and

- add up all the private miles, and

- work out what proportion was for business, and

- claim that much of each cost as motor expenses.

For example, if you travelled 1,000 miles in October, of which 500 were for business and 500 were private, then 50% of the use of the car was for business. If in October you spent £60 on petrol, then £60 x 50% = £30, so that’s the amount you can claim as a motor expense.

How to record motor expenses for the ‘full-cost’ method in FreeAgent

Using the above example, if you’re managing your expenses with FreeAgent, you’d split the payment of £60 into two transactions:

- £30 which you explain as motor expenses for the business journeys, and

- £30 which you explain as drawings for the private mileage

Hassle-free expense tracking with FreeAgent

Whether it’s running your vehicle or grabbing a coffee on the go, FreeAgent lets you track all the expenses you incur while running your business.

You can track bank payments and out-of-pocket expenses so there’s no reason to forget to record an expense again.

Find out more and start tracking all your expenses with a 30-day free trial.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.