What happens if you miss the tax return deadline?

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

Hundreds of thousands of taxpayers fail to file their Self Assessment tax return by the 31st January deadline each year, according to HMRC. If you ever find yourself in this situation, you may be worried about what’s going to happen to you and what actions you should take next.

1. Don’t panic

The first thing to remember is that filing your tax return a couple of days late should earn you nothing worse than a £100 fine, although HMRC will also charge you interest if you have failed to pay your tax on time too.

However, HMRC may start to charge additional penalties the longer you wait, so the quicker you submit your tax return and pay your tax bill, the better. You can use HMRC’s online tool to estimate your penalty for late Self Assessment tax returns and payments.

2. Establish if you had a ‘reasonable excuse’

HMRC says it will accept ‘reasonable excuses’ for missing the deadline. However, if your reason is along the lines of “I was too busy” or “my goldfish died” - both of which are actual excuses that have been submitted to HMRC - it shouldn’t come as a surprise to find out that these won’t enable you to bypass a fine.

What counts as a reasonable excuse?

According to HMRC, a ‘reasonable excuse’ is “when some unforeseeable or unusual event beyond your control has prevented you from filing your return on time”. The following examples have been highlighted by HMRC which could fit this criteria:

- When there’s a failure in the HMRC computer system that prevents you from filing

- When your computer breaks down just before or during the preparation of your online return

- When you have a serious illness, disability or serious mental health condition that makes you incapable of filing your tax return

- When you have registered for HMRC Online Services but didn’t get your Activation Code in time to submit your tax return before the deadline.

Further reading: HMRC provides \more information and examples of ‘reasonable excuses’ on its website.

How likely is it that HMRC will accept your excuse?

The examples above only apply if they actually prevented you from filing your return on time when you otherwise would have done. HMRC is unlikely to be lenient if it believes that you are at fault for missing the deadline. It’s therefore advisable to not only show proof of your situation to them, but also demonstrate that you have made some effort to overcome the problems, as HMRC will review each case on merit to decide whether it is a ‘reasonable’ excuse or not.

If in doubt, speak to your accountant and get their advice on whether you have a valid excuse for missing the filing deadline or not, or contact HMRC directly to explain your circumstances.

Just be prepared for the bad news that your excuse isn’t acceptable, and have £100 ready to pay the fine as soon as possible so you don’t face any additional penalties down the line.

What if your accountant didn’t file your tax return?

If you relied on your accountant to complete your Self Assessment but they failed to prepare and submit your tax return on time, you may think this is a reasonable excuse for missing the deadline. Unfortunately this is not the case, as HMRC still holds you responsible for your own tax affairs even if you have engaged an accountant.

3. Put systems in place for next year

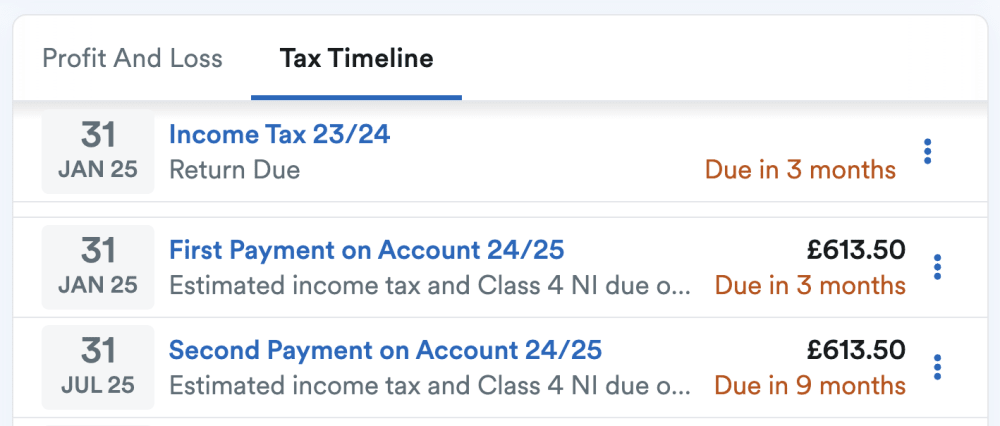

If you missed this year’s tax return deadline, make sure you don’t make the same mistake next year. By way of a quick plug, FreeAgent’s unique Tax Timeline feature shows all your upcoming tax deadlines and how much you owe - so you’ll never have to miss a Self Assessment deadline again.

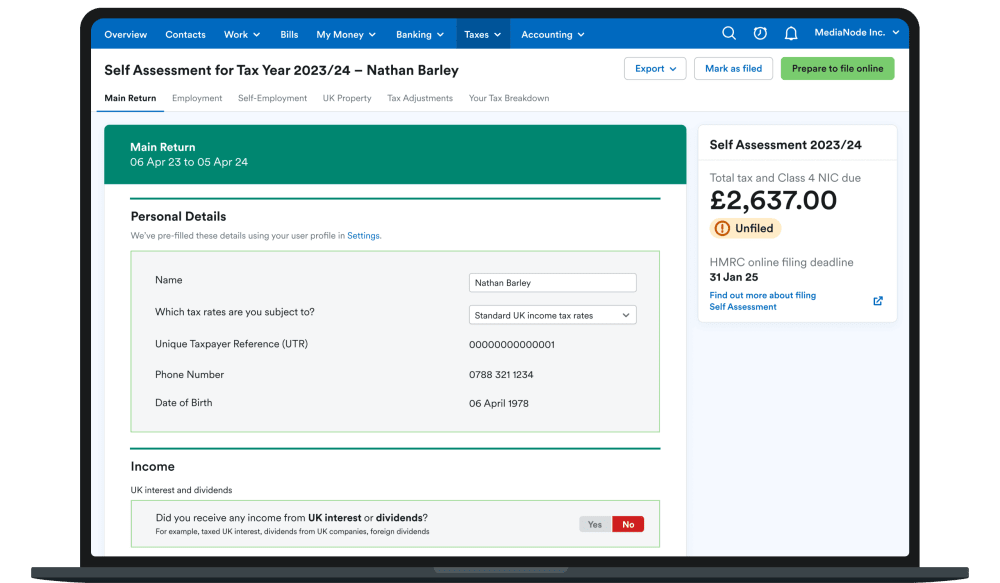

Take a closer look at FreeAgent’s easy-to-use Self Assessment software to see how effortless filing your tax return on time can be.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.