Small business growth strategy: how to survive, thrive and grow

If you’ve got a successful small business, you might be wondering about the next steps. How can you turn a small business into a big one? And how will you know if your business is ready to grow? This guide provides an overview of strategies for business growth, explains how to measure growth potential and offers some tips on where to find funding.

How to grow a business

1. Use the product/market matrix

The product/market matrix provides four strategies to grow your business, depending on your appetite for risk and the resources you have at your disposal.

| What’s it called? | What’s the strategy? | Is it risky? |

|---|---|---|

| Market penetration | Sell more of your existing products to existing customers | Low risk |

| Market development | Sell existing products to new customers | Medium risk |

| Product development | Sell new products to existing customers | Medium risk |

| Diversification | Sell new products to new customers | Higher risk |

Market penetration

The least risky – and potentially least expensive – way to grow your business is by increasing market penetration. This means getting your existing customers to buy more of what you’ve got.

You can do this through:

- promotions to encourage a higher spend

- loyalty schemes to keep them coming back to you instead of competitors

- digital marketing to stimulate extra sales

For example, if you’ve got a database of customers or a large social media following, an email promoting a special offer or a timely post about a product can increase demand. Anyone who’s had a post pop up from their local takeaway and bought one that night knows how effective this can be!

Product development

Product development is introducing a new product to your existing customers. For a retailer or service provider, this shouldn’t involve too much risk or financial commitment.

- A partywear shop could start stocking small presents, so partygoers can grab a gift on the go.

- A web design agency could expand their offer to include marketing services.

- A fitness instructor could start offering branded sportswear.

But if you’re a manufacturer, be mindful of cost and return on investment (ROI) before going into production. The key to successful product development is research. Ask your existing customers what else they’d be interested in buying, then work out if it’s viable and profitable.

Market development

If you’ve got a great product but maxed out your current market, it makes sense to find new audiences to sell to.

There are two types of market development: geographic development means finding similar customers in a new locality, while demographic development means finding a different type of customer altogether.

Depending on your business, geographic expansion could involve:

- opening up a second shop or satellite office

- offering delivery to reach a larger area than your immediate vicinity

- setting up an ecommerce site to sell internationally

Demographic expansion depends on your product, but means finding other people who might be interested in buying it. For example, customers of different genders, ages or occupations.

Diversification

The most challenging of all the strategies, diversification means selling new products in new markets.

At a local level, that could mean a cake shop owner seizes the opportunity to take on a commercial catering contract in the next town. On a larger scale, maybe they decide to set up an international online cookery school.

Given the challenges involved in diversification, which include discovering and understanding new markets and building relationships with new suppliers and distributors, you might wonder why anyone would do it.

But diversification spreads risk across sectors, opens up new opportunities and can be very rewarding.

2. Franchise your business

Everyone has heard of franchises like McDonald’s and Costa. But franchising is actually much more diverse than just fast food and coffee.

Almost any business can be franchised, meaning you give another person permission to trade under your business name, in exchange for a fee.

To franchise your business, you’ll need:

- a successful business (otherwise why would anyone want to buy in?)

- processes that can be easily replicated

- the ability to train and support your franchisee

The great thing about franchising is that, whilst it takes time and commitment to set up, once you’ve established the franchise model, you can create multiple franchises and further increase your income.

3. Buy another business

Another way to expand your empire is to buy another business. You might decide to buy out a competitor and expand your share of the market, or you might choose to buy a supplier, so you can have more control of your supply chain.

This can be a useful way to consolidate or diversify your market position. But it takes time, money and plenty of research into the company in question.

4. Expand your online offering

Harnessing the full power of the internet can have a transformative effect on businesses. This could mean adding a way for customers to buy online in order to expand your market, or developing a whole new product such as online classes, a subscription service or app to diversify your offer.

How to measure small business growth potential

Growing a business always involves a calculated risk, particularly when it involves investing money. But there are various indicators that can help you recognise when there is potential to expand.

Market indicators

- You have satisfied customers who sing your praises.

- Demand outstrips your ability to supply.

- Customer numbers are growing.

- Your market share is increasing.

Don’t forget: whichever growth strategy you choose, conduct market research to discover if there’s demand, suss out the competition, and understand how the economic and political climate could impact your chances.

Financial indicators

- There’s consistent growth in your revenue.

- Your profits are holding steady or growing.

- You’ve got a healthy cashflow.

- There’s money in the bank to invest.

- You can afford repayments if you need to borrow money.

Using accounting software such as FreeAgent can help businesses keep a close eye on their finances and spot trends at a glance.

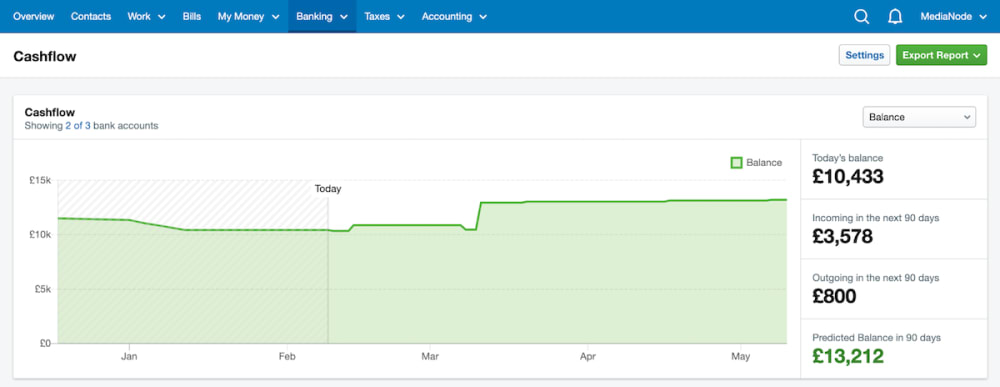

FreeAgent’s Cashflow feature provides a visual representation of your forecasted cashflow over the next 90 days, giving you an insight into your business’s near-term financial health.

Find out more about FreeAgent’s Cashflow feature

Human factors

- You feel you’re stagnating and are ready for a new challenge.

- You have the time and energy to dedicate to growing your business.

- Your team has the expertise and enthusiasm to support your vision.

Don’t underestimate the human factor. Change can be challenging and you’ll need to take your staff with you on the journey.

How to fund small business growth

It takes money to make money, so where can you find funding for small business growth? There are lots of options available to small businesses with big dreams. They include:

- personal finances and borrowing

- business borrowing from banks or via specialist providers like Transmit Growth

- investors (such as angel investors, venture capitalists and even crowdfunding)

- grants, particularly for businesses creating sustainable employment or environmental benefits

- reinvesting profits from the business

If you plan to apply for a loan or attract investment, you’ll need to prove you’re a sound investment. Banks will expect to see a business plan and accounts that indicate both financial potential and affordability. Investors will also want to see opportunities for return on investment and a timescale for realising their return.