Self Assessment, sorted!

Roan Lavery

CEO, Co-founder

They say you shouldn’t leave things until the last minute, but what do they know? Our new Self Assessment area has arrived just in time, if you’ve still got to nail that tax return.

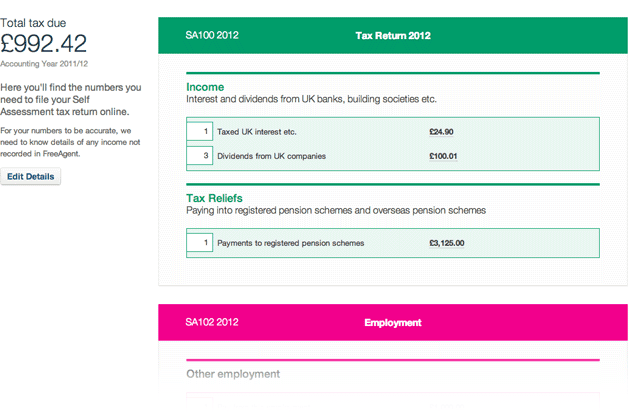

New Self Assessment Area

The first thing you’ll notice is the redesigned interface for 2011/12 and 2012/13 Self Assessment returns. The information has been laid out in a similar way to the official forms, making it easy to copy the numbers across when you fill in your tax return online.

Previous years will retain the original interface and calculations, and this is just for Sole Traders and Limited Companies at the minute - we’ll be supporting Partnerships in the future.

Not just a pretty face

The second improvement we’ve made is to the calculations that power our Self Assessment Tax projections. The previous forecasts were fine for many people, but weren’t as accurate as they could be for some of you.

We’ve now bolstered and refined our underlying calculations, to improve overall accuracy, which means that you may notice a slight difference in the projected Self Assessment tax liability figures for 2011/12.

There are more improvements coming soon, including support for payments on account.

Need a little more help?

Our new Self Assessment area should make filing your tax return a breeze but if you’re still struggling, we’ve put together The Self Assessment Checklist: a handy guide you can download, containing useful tips that should help you find a happy place with your tax return.

More FreeAgent Mobile

We’ve been blown away by the response to the mobile version of FreeAgent we launched in November, and it seems more and more of you are taking to managing your accounts on the go.

We’ve been steadily improving this, recently launching new mobile view for Estimates, Banking and Timesheets lists and creating Bills.

Stay tuned for more updates coming soon, including a start/stop timer for creating timeslips.

And finally

If you’ve added a BIC or IBAN number to your bank account you can now choose to display these on any invoice. Simply select this from the More Options section when you create the invoice.

Until next time,

Roan and the team at FreeAgent

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.