Paying back your student loan when you're self-employed

When you're self-employed, repaying your student loan requires a bit more DIY than it does when you're paid through a company payroll. From understanding your student loan plan to submitting repayments through Self Assessment, here's what you need to know.

Getting to grips with your student loan plan

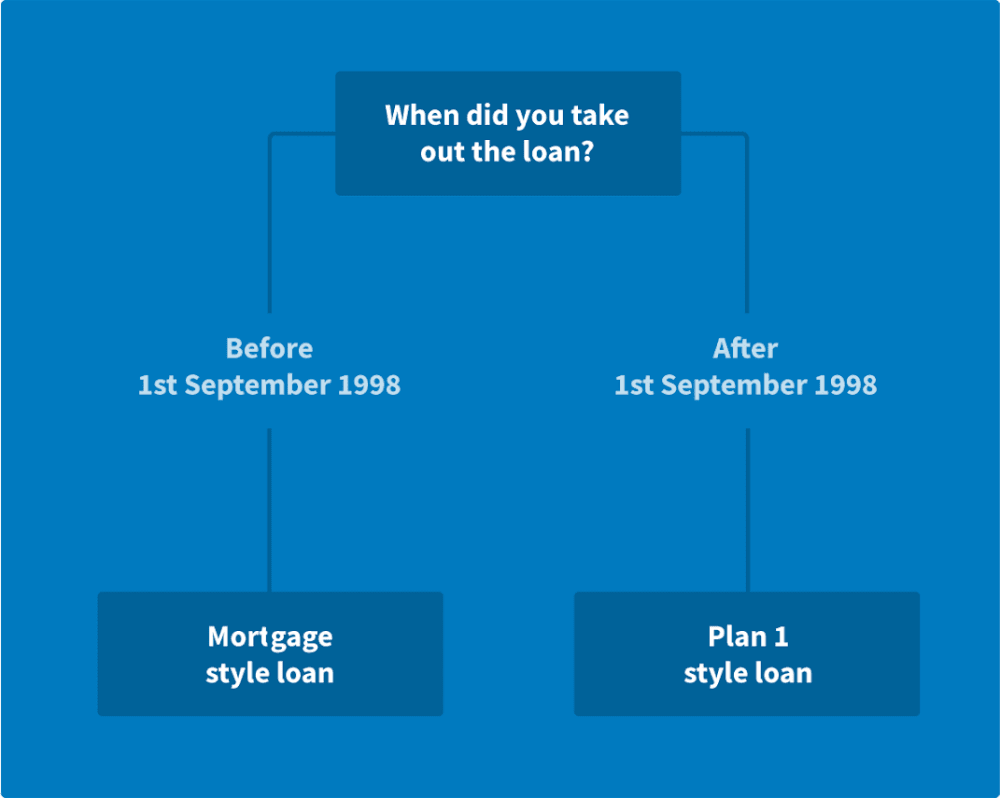

When you take out a student loan, you’re automatically enrolled into a plan. The plan you’re on will determine when you have to pay back your loan and the different thresholds you’ll be charged against.

Your plan depends on:

- when you took the loan out

- the UK country you were living in

- whether you studied an undergraduate or postgraduate degree

If you’re a UK resident and you studied in the UK, you’re likely to have been assigned one of the following student loan plans:

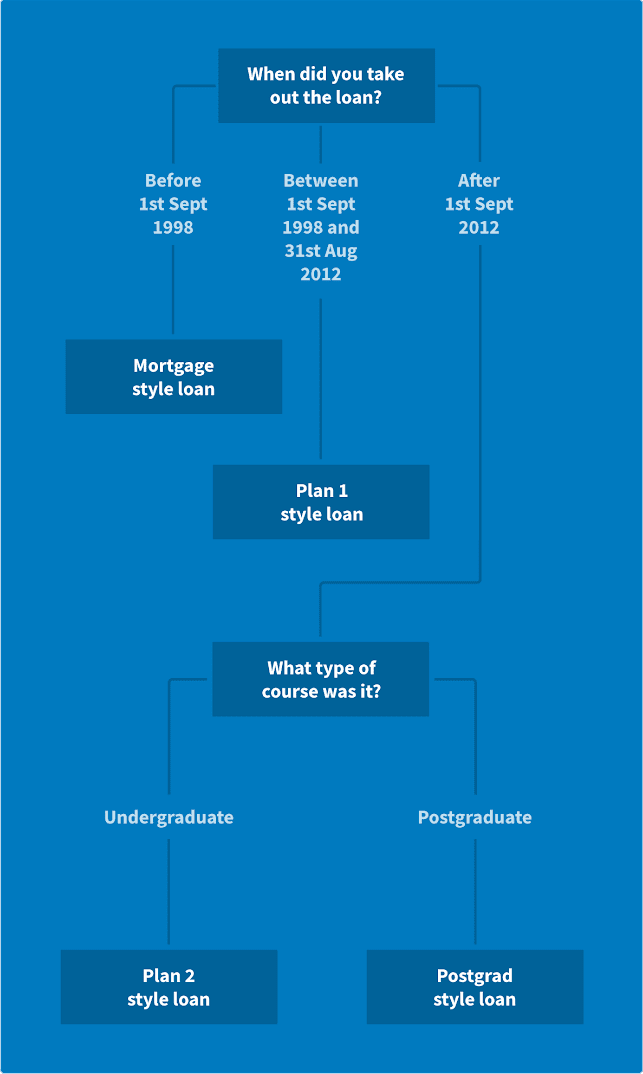

- Plan 1: Scottish and Northern Irish students who took loans out from 1st September 1998 onwards and English and Welsh students who took loans out from 1st September 1998 to 31st August 2012. Students on this plan currently start paying their loan back when their annual salary exceeds £24,990.

- Plan 2: English and Welsh students who took loans out after 1st September 2012. Students on this plan will start paying back their loan when their annual salary exceeds £27,295.

- Postgraduate Loans: This plan is for students who took out loans for PhD or Masters degrees in England and Wales after 1st September 2012. Students on this plan will start paying back their loan when their annual salary exceeds £21,000. Scottish and Northern Irish students with postgraduate loans are added to plan 1.

- Mortgage Style Loans: Students with loans predating September 1st 1998 in the UK have Mortgage Style Loans. Many of these loans have now been paid off and are managed by private companies such as Honour Student Loans, Thesis Servicing and Erudio Student Loans.

If you're unsure which student loan plan you're on, this handy flowchart should help:

The governance of student loans differs from country to country

For student loans in England, loan recipients can be on plan 1, plan 2, or have a postgraduate-style or a mortgage style loan. The governing body for England is Student Finance England.

For student loans in Wales, loan recipients can be on plan 1, plan 2, or have a postgraduate style or mortgage style loan. The governing body for Wales is Student Finance Wales.

For student loans in Scotland, loan recipients can either be on plan 1 or a mortgage style loan. The governing body for Scotland is the Student Awards Agency Scotland.

For student loans in Northern Ireland, loan recipients can either be on plan 1 or a mortgage style loan. The governing body for Northern Ireland is Student Finance NI.

Understanding how much you pay back each month

Your monthly repayments for student loans are based on your annual income before tax. Your income—whether it be from the salary you pay yourself, dividends or investments— decides whether you’re over the threshold for paying back your loan.

Different student loan plans have different thresholds. To find out what threshold you’re on for the 2025/26 tax year, see the table below:

| Annual Salary | Plan Type | |||

| Plan 1 | Plan 2 | Postgraduate Loans | Plan 4 (Scotland) | |

| £0-£20,999 | 0% | 0% | 0% | 0% |

| £21,00-£26,065 | 0% | 0% | 6% | 0% |

| £26,066-£28,470 | 9% | 0% | 6% | 0% |

| £28,471-£32,745 | 9% | 9% | 6% | 0% |

| £32,745+ | 9% | 9% | 6% | 9% |

If you’re over the threshold for your plan, you’ll pay that percentage on however much your income goes above that threshold. For example, a freelancer with a plan 1 loan won’t pay back 9% of their salary, they’ll pay back 9% on the salary amount which is over the threshold.

Plan 1 example

Sarah earns £25,500 as a freelance writer. She studied an undergraduate course in Northern Ireland so is on plan 1.

The starting payment point is £24,990, so she is £510 over the threshold. Sarah needs to pay back 9% of the amount she earns over the threshold.

Sarah’s salary - the threshold = £25,500 - £24,990 = £510

9% of £510= £45.90

Which means Sarah will pay back £45.90 a year, or £3.83 a month.

Plan 2 example

Leah is a freelance graphic designer who earns £30,000 a year. She took her loan out in England after 2012, so is on plan 2. Payments on plan 2 occur when your salary reaches £27,295. Therefore, Leah pays back 9% on what she owes over the threshold.

Leah’s salary - threshold = £30,000 - £27,295 = £2,705

9% of £2,705 = £243.45

So Leah pays back £243.45 a year, or £20.29 a month.

To find out the remaining balance of your student loan, you can check the goverment website.

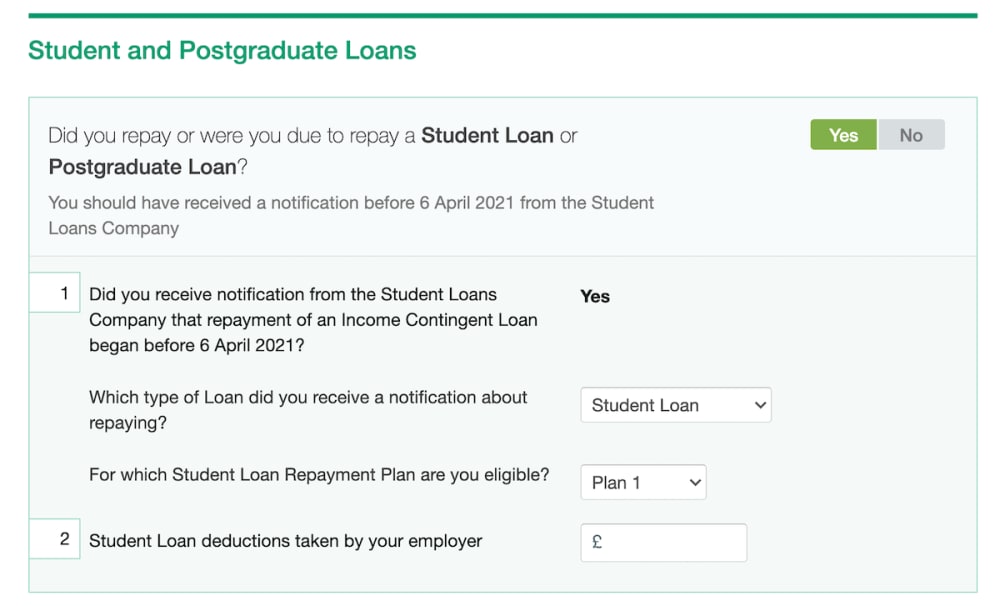

How freelancers pay back their student loan through their Self Assessment

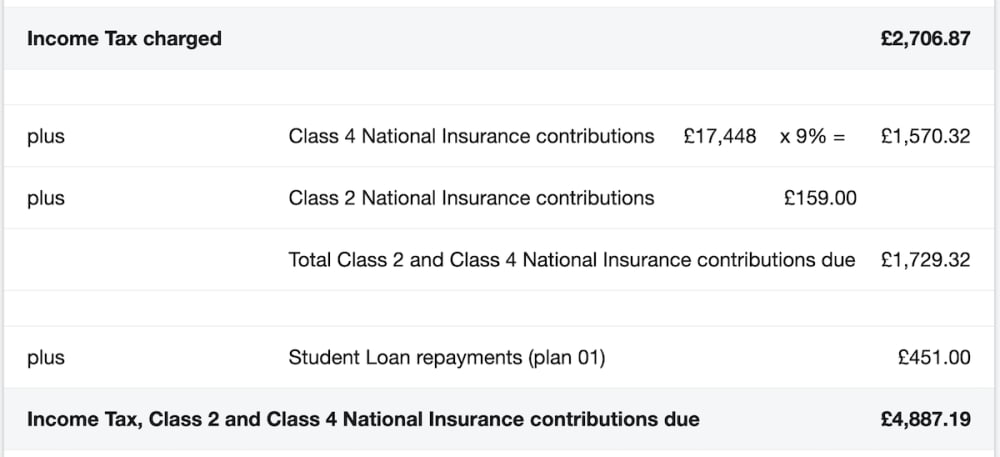

Unless you are a limited company director and take all your pay through your company’s payroll, HMRC assesses how much of your student loan you should repay each year through your Self Assessment tax return. When you complete your return, you can check a box to show that you have a student loan. HMRC will then let you know how much of your loan you need to pay.

FreeAgent’s accounting software allows you to complete your Self Assessment and upload it directly to HMRC. You can indicate which student loan plan you’re on, any deductions you’ve had from employers during the tax year and, when you’re ready, submit your completed tax return directly to HMRC.

FreeAgent can also estimate how much student loan you’ll be liable to pay, as well as your National Insurance and Income Tax liability.

Find out more about how FreeAgent can help you get your Self Assessment sorted here.

Frequently asked questions about student loans for self-employed people

Can I pay back more if business is going well?

If you’re in a position to pay back more than your student loan requires, you can make extra payments. An obvious advantage to this is that you won’t have your student debt hanging over you for as long.

However, Martin Lewis, author of the popular blog MoneySavingExpert.com, argues against this approach. Lewis argues that as student loans don’t affect your credit ratings, are low interest and automatically written off after 30 years there’s no incentive to pay them off early.

Can I pay back less if business is going badly?

Because your student loan repayments are tied to your Self Assessment income, your loan repayments will automatically be smaller if you’re earning less.

For business owners having an off year, this will be reflected in lower loan repayments.

If I’m operating through a limited company and my student loan comes out of my payroll, who administers this - me or my accountant?

That’s really up to you. You can do this yourself or you may wish to have an accountant complete your Self Assessment or administer your payroll.

Is there any help for small business owners struggling with student loan repayments?

There are many charities which offer help and advice for those that are studying with debts. Two of note are StepChange and the Debt Advice Foundation.

Frequently asked questions about student loans for everyone

Do student loans affect my ability to get a mortgage?

Student loans do not affect your ability to get a mortgage. What may be affected is the value of the mortgage you’re able to obtain. This is because mortgage value is calculated on your ability to make monthly repayments. Student loan repayments may reduce the amount of disposable income you have available and reduce the value of the mortgage you are able to secure against your income.

If you need advice on how to get a mortgage when you’re self-employed, this guide explains everything you need to know.

Can I take holidays or deferrals from my student loan?

You can’t formally defer or take a repayment holiday from your student loan, but you will not need to make payments if you’re under the earnings threshold for the year.

For example, if you are on plan 2, and your earnings for the tax year fall below £27,295, you’ll be able to take a break from your loan.

Do student loans get written off if I work abroad?

Students loans do not get written off if you work abroad. While it may seem as though some students escape overseas and slip through the cracks of student loan debt collection, this is generally a misconception.

If you’re thinking of working overseas, it's working checking with the body that manages your loan to check how this will affect your repayments.

Are student loans tax deductible?

Unfortunately, no. Student loans are not a tax deductible benefit for self-employed people.

Do student loans affect my credit score?

No. Unlike many other forms of loans and credit, student loans do not affect your credit rating.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.