Your Making Tax Digital for VAT questions answered (even the difficult ones)

In this guide, we’ve answered the most common questions that accountants have asked us since Making Tax Digital (MTD) was introduced in 2019. If you’re not an accountant but want to know more, take a look at our collection of MTD resources for small businesses.

Click through to your most pressing question or read on to take in the full list:

- What is MTD for VAT?

- When did MTD for VAT begin?

- Is FreeAgent MTD-compatible?

- How is MTD VAT filing different in FreeAgent?

- What should I be doing to prepare?

- Who can file the return?

- Are the deadlines for VAT return submissions still the same?

- What about VAT special schemes?

- What information needs to be submitted?

- What information needs to be stored?

- What about VAT registered businesses with VATable sales below the threshold?

- What’s next on the MTD agenda?

1. What is MTD for VAT?

MTD for VAT is the first major phase in the Making Tax Digital initiative, the government’s plan to make tax administration more effective, more efficient and easier for taxpayers through the introduction of a fully digital tax system. It first required certain VAT-registered businesses to keep digital records and use MTD-compatible software to submit their VAT returns electronically. The scope of MTD for VAT expanded on 1st April 2022 and all VAT-registered businesses are now required to follow these rules.

All VAT returns have to be filed through HMRC’s MTD APIs (the interfaces that enable accounting systems to communicate with HMRC’s systems).

2. When did MTD for VAT begin?

Businesses with VATable turnover in excess of the VAT threshold of £90,000 (as of 1st April 2024) had to make their first MTD-compatible VAT submission for the first VAT period that started on or after 1st April 2019.

The scope of Making Tax Digital for VAT expanded in 2022. All VAT-registered businesses, regardless of turnover, must now use MTD-compatible software to store their business records digitally and submit VAT returns to HMRC for all their business’s VAT periods starting on or after 1st April 2022.

Find out more on HMRC’s website.

3. Is FreeAgent MTD-compatible?

Of course! FreeAgent is MTD-compatible and HMRC lists FreeAgent as one of the software suppliers supporting Making Tax Digital for VAT. We’re confident that FreeAgent will continue to be the best accounting software for your small business clients in the MTD era.

Our support team are trained specifically on MTD for VAT to ensure that they can provide you with the best advice.

4. How is MTD VAT filing different in FreeAgent?

Filing your clients’ VAT returns through our software is as simple as ever and once you’ve made your first MTD submission the process remains largely the same. However, two-way communication with HMRC’s systems improves the overall experience.

Through the use of oAuth technology (which allows a user to authorise a third party to access their account information while keeping their password hidden and their data secure) you can connect your FreeAgent account to HMRC. This will continue to allow VAT return filing directly from the app with the touch of a button and allow client data that HMRC holds – such as information on outstanding liabilities and payments the business has made towards VAT – to be pulled into FreeAgent.

Your first MTD VAT submission

During your first MTD VAT submission from FreeAgent you’ll be prompted to:

- click through to the HMRC website

- enter your credentials in order to receive a token which enables your data to pass securely between the two systems (this is automated – entering your credentials will automatically assign you a token)

- return to FreeAgent where the token will be stored for 18 months

This process means that your account dashboard will be authorised to file MTD VAT returns. If you switch to a client linked to your dashboard you’ll be able to file on their behalf, as long as they’ve authorised you to do so.

After this initial step, VAT filing in FreeAgent will involve the familiar process of checking the details, ticking a confirmation box and clicking the “submit” button.

5. How can I help my clients?

We’ve worked hard to ensure that the switch to MTD is as painless as possible for your practice, but there are a few things that you need to do:

- Determine which clients fall under the scope of MTD for VAT.

- Ensure all clients who fall under the scope of MTD for VAT are using MTD-compatible software, like FreeAgent.

- Communicate with your affected clients about their obligations.

- Set up an agent services account with HMRC.

- Add all clients who fall under the scope of MTD for VAT to your agent services account and subscribe them to MTD. You should only take this final step when you are ready to file through MTD – as soon as you subscribe a client, HMRC will expect the next return to be MTD-compatible.

The agent services account in steps four and five is different to your current Government Gateway account and is the account you’ll use to access the majority of HMRC online services for MTD.

In most cases, in order to subscribe a client to MTD with an agent services account you’ll need your client’s VAT Registration Number (VRN), Company Registration Number (CRN) and National Insurance Number (NINO).

Your affected clients will have to confirm that they can be added to your account via their own HMRC online account. It’s a good idea to chase up your clients and make sure that they have valid Government Gateway credentials ahead of time to save you chasing them up at the last minute!

Get more practical tips and resources in our MTD for VAT practice preparation guide →

6. Who can file the return?

Both you – the agent – and your clients will be able to submit VAT returns. If your client has already authorised you to file their VAT returns, their authorisation will be passed on to your agent services account. In order to file VAT returns for new clients, or clients who have not yet authorised you to do so, you’ll have to seek their authorisation.

When you have your agent services account set up you’ll be able to send affected clients an invitation to authorise you. This process might take a while, especially if you have a lot of clients to seek authorisation from, so make sure you communicate this step well ahead of time.

Once your client authorises you to submit their returns, your existing working relationship for VAT can continue in the same way, whether your client inputs the data for you to review and file or give you raw data to input.

7. Are the deadlines for VAT submissions still the same?

Yes, the payment deadlines and the frequency with which businesses have to file VAT returns will be the same as they were before MTD. This applies to monthly, quarterly and annual VAT return schemes.

You will continue to make error corrections on VAT returns on the following quarter’s VAT return or by writing to HMRC.

As of January 2023, a new penalty system applies to MTD late submissions, with those missing a deadline earning a penalty point.

8. What about VAT special schemes?

Eligibility for VAT special schemes, such as the Flat Rate Scheme, remains the same. Businesses eligible to submit annual VAT returns are still able to do so under MTD.

9. What information needs to be submitted?

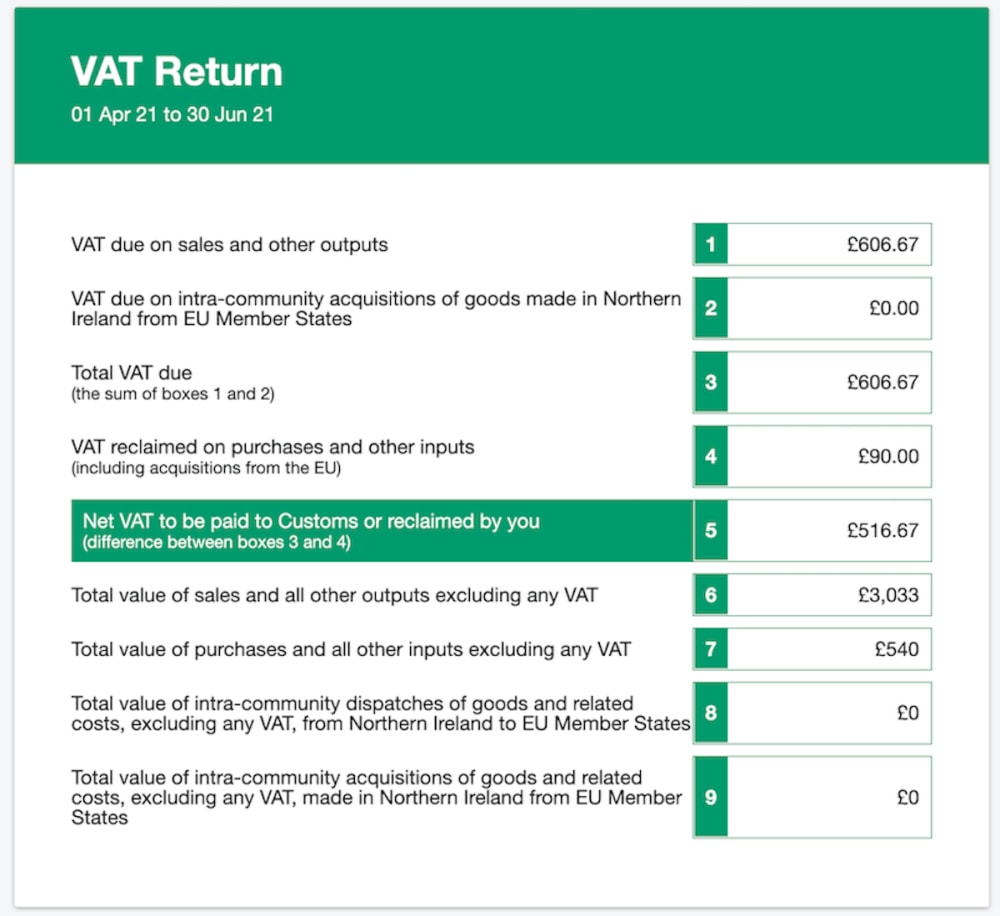

While businesses need to keep a record of all their transactions in MTD-compatible software, HMRC only requires summary data in each VAT submission. This takes the form of the familiar nine boxes on the VAT return:

- VAT due on sales and other outputs

- VAT due on acquisitions from other EC member states

- Total VAT due (the sum of boxes 1 and 2)

- VAT reclaimed on purchases and other inputs (including acquisitions from the EC)

- Net VAT to be paid to Customs or reclaimed by you (Difference between boxes 3 and 4)

- Total value of sales and all other outputs excluding any VAT

- Total value of purchases and all other inputs excluding any VAT

- Total value of all supplies of goods and related costs, excluding any VAT, to other EC member states

- Total value of acquisitions of goods and related costs, excluding any VAT, from other EC member states

10. What information needs to be stored?

Remember that the above is the information that has to be submitted for VAT; under MTD your clients are required to store certain information digitally. This should include, for each supply:

- the time of supply (tax point)

- the value of the supply (net excluding VAT)

- the rate of VAT charged

Records should also include your clients’ business name, business address, VAT registration number and details of any VAT accounting schemes they use. All this information is automatically stored and updated in FreeAgent.

If you need to make adjustments to your VAT figures (for example, if your client is partially exempt from VAT) the calculations and supplementary data that get you to your final figures don’t have to be stored.

There is no additional information you or your clients need to store or submit for MTD for VAT; however, this information now needs to be stored digitally.

11. What about VAT-registered businesses with VATable sales below the threshold?

In 2019, businesses with VATable sales below the VAT threshold could voluntarily join MTD for VAT if they wished, but were not mandated to do so. The scope of MTD for VAT expanded on 1st April 2022 and all VAT-registered businesses, regardless of turnover, are now required to follow these rules.

12. What’s next on the MTD agenda?

In April 2026, HMRC will introduce MTD for Income Tax for self-employed individuals and landlords. Check out our Making Tax Digital guides and resources for more information.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide.