Is there VAT on train tickets? (and other common VAT questions)

VAT: what can you claim?

VAT is a tax charged on a range of goods and services that can be purchased for use by a business. If your business is registered for VAT, you can often reclaim this tax as a refund from HMRC by filing a VAT return.

VAT is charged at different rates for different products and services and you can only reclaim what you pay for. Most of the time this means you can reclaim VAT at the standard rate (20% of the cost of the product or service) or at the reduced rate (5%). However, while VAT technically exists on zero-rated products it is charged at 0% - so you don’t pay anything extra and as a result can’t claim anything back!

VAT is one of the most complicated areas of the UK tax system and as a small business owner you might often be left scratching your head over what items are exempt from VAT and what you can claim back. If you’re struggling to figure out what goods and services are exempt from VAT (and therefore what you can and can’t claim VAT back on), this guide will help.

Jump to a section or read on to learn more:

1. Can you claim VAT back on travel?

2. Can you claim VAT back on food and drink?

3. Can you claim VAT back on property?

Can you claim VAT back on travel?

Train tickets

No - train tickets are zero-rated for VAT so you can’t claim anything back.

Bus fares

No - like train tickets and most public transport costs, bus fares are zero-rated for VAT so you can’t reclaim anything on them.

Taxi fares

Yes - you can usually claim VAT on taxi fares at the standard rate (20%) unless the taxi driver is self-employed and not registered for VAT - always ask for a VAT receipt. It’s worth noting that the majority of Uber drivers are self-employed and earn under the VAT threshold, so you can’t usually reclaim VAT on Uber fares.

Fuel and mileage

Yes - VAT is charged and can usually be claimed on petrol and diesel at the standard rate of 20% for business travel. If your accounts come under investigation from HMRC, you may be asked to provide a travel log to prove the journey was business related. The log should include:

- where the journey started and ended, including postcodes

- who you visited and why

- the date of the journey

- mileage

Mileage for business journeys can also be claimed as an expense; you can find out more in our guide to motor expenses. If you’re claiming a mileage allowance rather than the actual costs of your journey, you can only reclaim VAT on the fuel element of the mileage allowance.

Flights/air travel

No - air travel is zero-rated for VAT so you can’t claim anything back.

Car parking

Maybe - street parking is exempt from VAT so you can’t claim back VAT on charges from a parking meter. Private car parks, however, may charge VAT if the car park business is VAT-registered, so you should always check your receipt for a VAT number. If there’s a VAT number on your receipt you should be able to reclaim VAT on parking charges.

Car hire/leasing

Yes - if you hire or lease a car then you can usually reclaim at least 50% of the VAT on the hire fees. You may be able to reclaim 100% of the VAT charge if the car is only used for business purposes and is not available for private use.

Commercial vehicles/company cars

Maybe - you can sometimes reclaim the VAT for buying a car if you use it exclusively for business purposes. HMRC is strict about this, so reclaiming VAT on a car can be a challenge unless in certain circumstances, such as for a taxi or a driving school car. VAT is charged at the standard rate of 20% for almost all new cars and vehicles but this rate may differ for second-hand purchases (see below).

You may also be able to reclaim VAT on a commercial vehicle if it is used exclusively for business purposes. Commercial vehicles include tractors, vans and lorries but you may also be able to reclaim VAT on motorcycles, motorhomes, combi vans and car-derived vans if they are used entirely for business purposes.

Congestion charge

No - as statutory fees, such as the London congestion charge, are outside the scope of UK VAT, you cannot reclaim VAT on them.

Vehicle insurance

No - vehicle insurance is exempt from VAT so you can’t claim anything back.

Second-hand cars

Maybe - cars that are bought and sold privately (i.e. by anyone outside the motor trade), are outside the scope of VAT. However, if a car is bought from a VAT-registered dealership then the tax may apply. The rate of VAT applied may vary due to The Margin Scheme, so it’s important to check your receipt to see how much you’ve been charged.

MOTs

Maybe - MOTs are outside the scope of VAT, provided that the cost does not exceed the statutory maximum. Any costs over and above the statutory maximum should be expected to be standard-rated for VAT.

Vehicle road tax

No - UK road tax is outside the scope of VAT.

Can you claim VAT back on food and drink?

Coffee

Maybe - a jar of coffee bought from a shop is zero-rated for VAT, so you can’t claim anything back. However, coffee that is bought as a hot beverage (i.e. from a cafe, restaurant or takeaway) is standard rated at 20%, but you can’t reclaim this VAT if you bought the coffee for the purpose of business entertaining.

Milk

No - milk (including soya, rice and coconut milk) is zero-rated for VAT, therefore you can’t claim anything back. This also extends to flavoured milk drinks, including milkshakes.

Cakes

No - cakes are zero-rated for VAT, therefore you can’t claim anything back. Even if a cake is still warm when it’s sold, it remains zero-rated as it’s not sold with the intention of being eaten hot. If you go ahead and eat it before it cools we promise not to tell!

Bottled water

Yes - bottled water is taxed at the standard rate of 20% for VAT.

Biscuits

Maybe - biscuits are zero-rated for VAT unless they are wholly or partially coated in chocolate, in which case they are charged at the standard rate of 20%.

Chocolate

Yes - chocolate bars, including diabetic chocolate, are standard-rated for VAT at 20%.

Alcohol

Yes - alcoholic beverages (including beer, cider, wine, spirits and liqueurs) are standard-rated for VAT at 20%. Again beware that you can’t reclaim VAT on alcohol bought for the purpose of business entertaining.

Sandwiches

Maybe - shop-bought sandwiches, such as those sold in supermarkets, are zero-rated for VAT, so you can’t claim anything back.

Cold sandwiches bought in an eatery such as a cafe or sandwich outlet are zero-rated if they are not consumed on the premises. However, they are charged at the standard rate of 20% if they are consumed on the premises. This is why ‘eat-in’ and ‘takeaway’ prices often differ in cafes.

Hot sandwiches are charged at the standard rate of 20% wherever you choose to eat them.

Restaurant food

Maybe - food purchased and consumed in a restaurant is usually charged at the standard rate of VAT (20%) regardless of whether it’s hot or cold. One exception to this rule is if you buy cold food from a restaurant but don’t eat it on the premises. Again beware that you can’t reclaim VAT on meals bought for the purpose of business entertaining.

Reclaiming VAT on food and drink

In order to claim any VAT on food and drink, HMRC will have to be satisfied that it qualifies as a reasonable business cost - which can be tricky! Our guide to claiming expenses for the cost of food and drink has more information on this topic, but it’s always wise to check with your accountant before claiming any tax.

Can you claim VAT back on property?

VAT on building work and renovations

Maybe - VAT for most work on houses and flats by builders, plumbers, plasterers, carpenters and similar trades is charged at the standard rate of 20%.

However, building work for a new home or for aiding people with disabilities may be zero-rated for VAT.

Building a new home

Maybe - when building a new home, VAT is likely to be charged on the supply of materials only. However the supply of labour or the joint supply of labour and materials is likely to be zero-rated, so you won’t be able to claim anything back.

You can apply to HMRC for a VAT refund on building materials if you are building a new home or converting an existing non-residential property into a home. This also applies to non-profit communal residences such as hospices. You must apply to HMRC for this refund within three months of completing the work to be eligible.

Estate agent fees

Yes - estate agent fees are charged at the standard rate of 20%. Can you claim VAT on amenities?

Water

Maybe - water supplied to households and most premises is zero-rated for VAT, so you can’t claim anything back. Some businesses in the manufacturing, construction and engineering sectors may be required to pay VAT at the standard rate of 20% for water.

Electricity bills

Yes - VAT is charged at the reduced rate of 5% for the supply of electricity to domestic properties or for non-business use by a charity. Electricity supply for business use is usually charged at the standard rate of 20%.

Gas bills

Yes - VAT is charged at the reduced rate of 5% for the supply of gas to domestic properties or for non-business use by a charity. Gas supply for business use is usually charged at the standard rate of 20%.

Other common VAT questions

Can you claim VAT on insurance?

No - insurance is largely exempt from VAT and doesn’t incur any charges beyond Insurance Premium Tax (which is different from VAT), so you can’t claim anything back.

Can you reclaim VAT for bad debts?

Yes - you can reclaim the VAT that you’ve paid HMRC but have not received from a customer if it’s a ‘bad debt’ (i.e. one you do not expect to be paid). To qualify for the relief:

- the debt must be between six and 54 months old

- you must not have sold the debt on

- you must not have charged more than the normal price for the invoice item on which the debt has been incurred

Can you claim VAT on newspapers?

No - newspapers are zero-rated for VAT so you can’t claim anything back.

Can you claim VAT on sales to non-EU countries?

No - VAT is a tax on goods used in the EU. If goods are exported outside the EU they are zero-rated for VAT.

Can you claim VAT on charitable donations?

No - voluntary donations to charity are outside the scope of UK VAT, so you can’t claim anything back.

Can you claim VAT on stationery?

Yes - stationery is usually standard-rated for VAT at 20%.

Can you claim VAT on batteries?

Yes - batteries are usually charged at the standard rate of 20%. Certain batteries can be charged at the reduced rate of 5% when sold alongside a solar photovoltaic system.

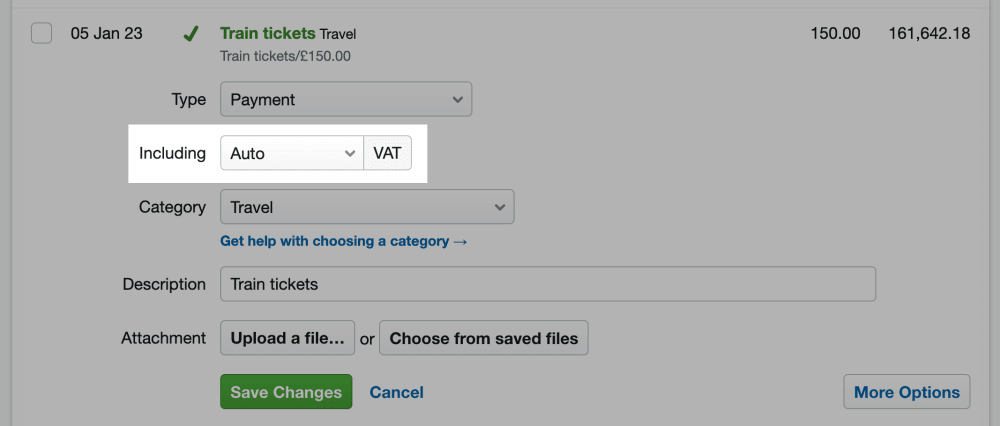

Accounting for VAT in FreeAgent

When explaining bank transactions in FreeAgent, you can select ‘Auto’ and the software will automatically apply the relevant rate of VAT for the category you’re allocating the transaction to. This means that if you know a payment is for travel, you often don’t have to worry about knowing the correct rate of VAT off the top of your head. If you do know the correct rate of VAT, you can also select this within the software!

Find out more about online VAT filing with FreeAgent.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.