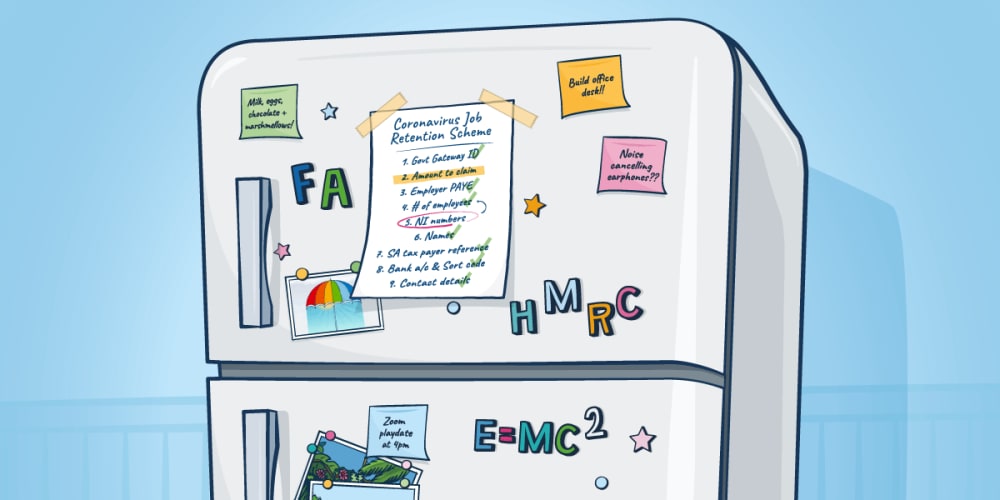

9 things you need in order to make a claim through the Coronavirus Job Retention Scheme

This article was last updated on 22nd June 2020

Looking to make a claim for your furloughed employees through the Coronavirus Job Retention Scheme? This guide explains exactly what information you’ll need.

1. Your Government Gateway ID login details

To submit your claim on HMRC’s website you’ll need to sign in to your Government Gateway account using the Government Gateway user ID and password you received when you registered for PAYE online. If you’re having trouble signing in, check this guide on retrieving your HMRC account information.

2. The amount that you’re claiming for each employee

For each employee who you’re claiming for under the scheme, you will need to calculate the following amounts:

- 80% of their monthly salary, up to £81.52 per day

- your monthly employer National Insurance contributions (NICs) for the employee

- your monthly minimum auto-enrolment pension contributions for the employee

If you use FreeAgent’s payroll, you can amend your employee payslip details to include furloughed days. This will automatically produce a monthly report in FreeAgent, containing the details you’ll need for your Coronavirus Job Retention Scheme claim.

If you don’t use FreeAgent, we’ve created a handy furlough claim calculator for monthly payroll to help you work out the numbers you’ll need.

3. Your employer PAYE reference number

You’ll need to include your employer PAYE reference number - also known as an employer number or ERN - in any claims you make through the Coronavirus Job Retention Scheme. You can find this number in your FreeAgent account by selecting ‘Settings’ then clicking on ‘Company Details’.

Your employer PAYE reference number is also printed on any payslip, P45, P60 or P11D that you have issued to past or present employees and on any correspondence from HMRC about PAYE. You can also find the number in the booklet you received in your welcome pack from HMRC when you first registered as an employer.

4. The number of employees being furloughed

Although you need to make a claim for each furloughed employee individually, you’ll still need to enter the total number of furloughed employees in your business when you make each claim. You should be able to get this information easily from your payroll system. In FreeAgent, you can get the list of your furloughed employees from the new furlough report.

For claim periods starting on or after 1st July, there will be a limit to the number of employees you can claim for through the Coronavirus Job Retention Scheme. You will not be able to claim for more than the maximum number of employees you claimed for in any single claim period up to 30th June. If your highest single claim until that date had been for 100 employees, for example, you would be unable to claim for more than 100 employees in claim periods from 1st July onwards.

5. Your furloughed employees’ full names

You should be able to get your employees’ full names from your payroll system. In FreeAgent, you can see the list of your employees by selecting ‘My Money’, clicking on ‘Payroll’ and scrolling down to the ‘Employees’ table.

6. Your furloughed employees’ National Insurance (NI) numbers

You’ll be able to find your furloughed employees’ NI numbers on any previous payslips. In FreeAgent, you can find employees’ NI numbers from the furlough report. You can also find these numbers in the Payroll area by selecting a previous payroll month from the drop-down menu and clicking the ‘Edit Payroll’ box next to each employee’s name. Check this guide on reviewing and editing payslips for more detail.

If you don’t have a National Insurance number for any of your furloughed employees, check this guide on how to find it.

7. Your Self Assessment unique taxpayer reference (UTR), Corporation Tax unique taxpayer reference (UTR) or company registration number

In FreeAgent, you can find your Self Assessment UTR by navigating to ‘Settings’ and selecting ‘Users’. For your Corporation Tax UTR or company registration number, navigate to ‘Settings’ and select ‘Company Details’.

If you don’t use FreeAgent, you can find your Self Assessment UTR number in your HMRC online account. The number is also printed on any letters sent by HMRC about Self Assessment, such as your notice to complete a tax return. Be aware that the number might be referred to simply as ‘tax reference’ in these letters.

If you’re a limited company director, you can find your 10-digit Corporation Tax reference number on letters from HMRC.

You can find your company registration number on your certificate of incorporation from Companies House. If you can’t find your certificate of incorporation go to the Companies House website, choose ‘Find Company Information’, enter your company’s registered name and you’ll be able to see your company’s registration number.

8. Your bank account number and sort code

This is the bank account that HMRC will transfer the money into if your claim is successful. The bank account you use must be based in the UK. Once HMRC has verified your claim, you’ll receive the money into your bank account within six working days.

9. Your contact details

HMRC also asks for your contact details when you submit a claim, so be sure to have your phone number to hand as well.

Submitting your claim

HMRC’s furlough processing system is now live. When you’ve gathered the information outlined above, sign in to your Government Gateway account to begin the process of making a claim.

Employers are expected to receive the money within six working days of submitting an application.

If you make an error

If you make an error when claiming that results in the government paying you more than you were entitled to you should inform HMRC when you make your next claim. Your next claim will usually be adjusted so that you repay the overclaimed amount.

If the error means you receive less than you were entitled to, you should contact HMRC to resolve the issue.

If you have overclaimed any amount but do not plan to make any further CJRS claims, HMRC are currently working on a system to allow you to notify them. However, this system has not yet been rolled out.

To learn more about what the coronavirus crisis could mean for your business and to stay up to date with the latest news, take a look at our small business coronavirus hub.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.