Allowable expenses calculator for landlords

Use this tool to calculate the amount of allowable expenses you can deduct from your property income when you calculate your taxable profit.

The tool is designed for landlords of UK-based properties who:

- are resident in the UK

- are an individual rather than a company

- are the sole owner of the property they let

- do not live in the property they let

The tool should be used to calculate allowable expenses relating to one property at a time, for a single tax year.

Answer the following questions to calculate the total amount of allowable expenses you can claim in relation to a single property from which you earn income. If you’re unfamiliar with any of the vocabulary used here, we recommend that you read our guide on allowable expenses for landlords before you get started.

What are 'allowable expenses' for landlords?

If you receive income of over £1,000 from letting out a property, it’s likely that you'll have to file a Self Assessment tax return, declare the taxable profit you made on your property income and pay Income Tax on that figure every year.

When filing your tax return, there are a number of expenses that you may be able to deduct from your income in order to work out your taxable profit. These are known as allowable expenses.

*Disclaimer: While we have made every attempt to make sure that the calculations are correct, FreeAgent Central Ltd cannot be held responsible for incorrect output from this calculator or for the outcome of any decisions you make as a result of using it. Full terms and conditions.

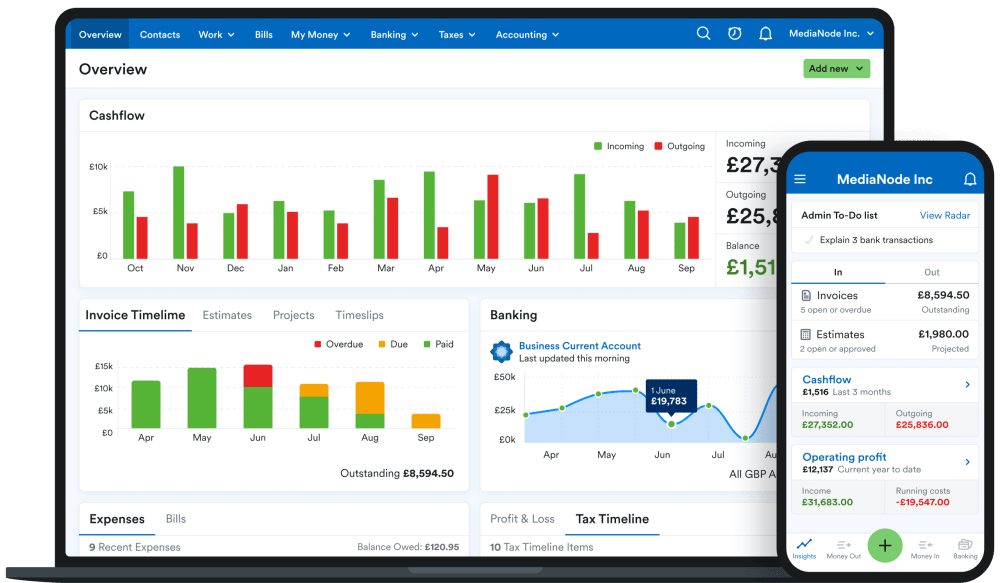

Say hello to FreeAgent!

Award-winning accounting software trusted by over 200,000 small businesses and freelancers.

FreeAgent makes it easy to manage your daily bookkeeping, get a complete view of your business finances and relax about tax.