4 steps to complete before filing your first quarterly MTD VAT return

Waiting patiently to file your first VAT return under Making Tax Digital (MTD) for VAT since the legislation expanded earlier this year? While your first MTD for VAT filing deadline might still be a few weeks away, there are certain steps you need to complete in advance in order to make the submission successfully. Here’s a reminder of everything you need to do before filing your first quarterly MTD VAT return, using FreeAgent as your compatible accounting software.

1. Sign up for MTD for VAT with HMRC

The first step in the process of getting ready to file VAT returns under MTD is signing up for MTD for VAT with HMRC. You'll receive an email within 72 hours of completing this step to confirm that you can submit VAT returns using your chosen software.

Your deadline for signing up for MTD for VAT with HMRC depends on:

- the start date of your business’s first VAT quarter dated on or after 1st April 2022

- the method you use to pay VAT

VAT quarter starting 1st April 2022

If your first required MTD VAT return is for the VAT quarter starting in April 2022, it will be due on 7th August 2022:

- If you pay VAT by Direct Debit, you will need to sign up for MTD for VAT with HMRC by 31st July.

- If you pay VAT by another method, you will need to do this by 4th August.

VAT quarter starting 1st May 2022

If your first required MTD VAT return is for the VAT quarter starting in May 2022, it will be due on 7th September 2022:

- If you pay VAT by Direct Debit, you will need to sign up for MTD for VAT with HMRC by 31st August.

- If you pay VAT by another method, you will need to do this by 4th September.

VAT quarter starting 1st June 2022

If your first required MTD VAT return is for the VAT quarter starting in June 2022, it will be due on 7th October 2022:

- If you pay VAT by Direct Debit, you will need to sign up for MTD for VAT with HMRC by 30th September.

- If you pay VAT by another method, you will need to do this by 4th October.

2. Sign up to FreeAgent

Signing up for compatible accounting software is the second step of the process. FreeAgent, our easy-to-use, MTD-compatible software, is designed especially for small businesses. It generates your VAT return automatically each quarter, using the data in your account to populate the return. You can then file your completed VAT return directly to HMRC in just a few clicks. The software includes a stack of other great features to help small business owners relax about tax, nail the daily admin and see the bigger business picture.

Signing up to FreeAgent is quick and simple. If you have a business current account with NatWest, Royal Bank of Scotland or Ulster Bank NI, or a business account with Mettle, you can get FreeAgent for free, for as long as you retain your account. You can also sign up for a 30-day free trial of the software.

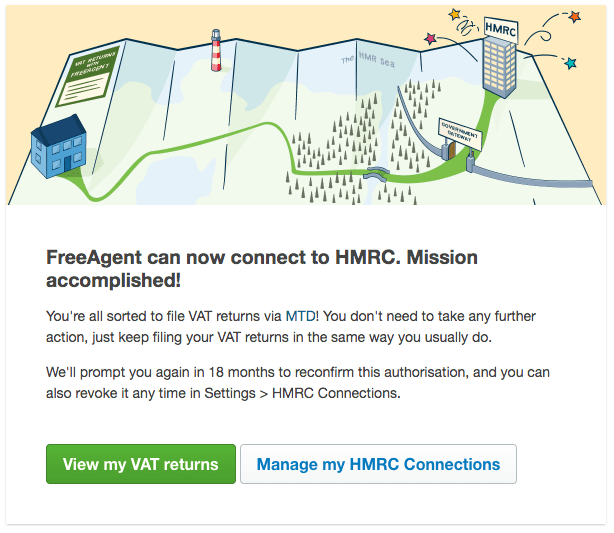

3. Connect FreeAgent to HMRC

Once you’ve signed up for MTD for VAT with HMRC and then signed up to FreeAgent, you’ll set up the MTD for VAT connection in the software to link the two together. This process should only take a few minutes and at the end you’ll see this message:

4. Get your accounts in order

If you’re new to FreeAgent there are a few tasks you’ll need to complete in the software before you can file your first VAT return, like setting your accounting dates and entering all your accounting data. If you’re already using FreeAgent, it’s important to make sure your accounts are ready for VAT filing before you make a submission. In both cases, you should set time aside to prepare your accounts in FreeAgent before filing a VAT return through the software.

Once you’ve completed these steps, you’ll be able to file your VAT return directly to HMRC through FreeAgent in just a few clicks.

Find out more about Making Tax Digital and how FreeAgent can help.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.