How to amend a Self Assessment tax return after filing it

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

It can happen to the best of us. You file your Self Assessment tax return to HMRC before the deadline and then realise that you made a mistake on one of the forms. Luckily, HMRC has devised a simple process to help you correct errors on a tax return that you’ve already filed.

Important: We strongly recommend that you check with HMRC or an accountant before making any changes to a filed tax return.

How to correct an error if you filed your tax return online

If you filed using HMRC’s portal

If you filed your tax return using HMRC’s online portal, you can correct the error by signing in to the portal with your Government Gateway user ID and password and navigating to ‘Your tax account’.

From there, navigate to ‘Self Assessment account’ and then ‘More Self Assessment details’ > ‘At a glance’ > ‘Tax return options’.

Choose the tax year of the Self Assessment tax return that you want to edit. Make the necessary corrections to the tax return and then file it again.

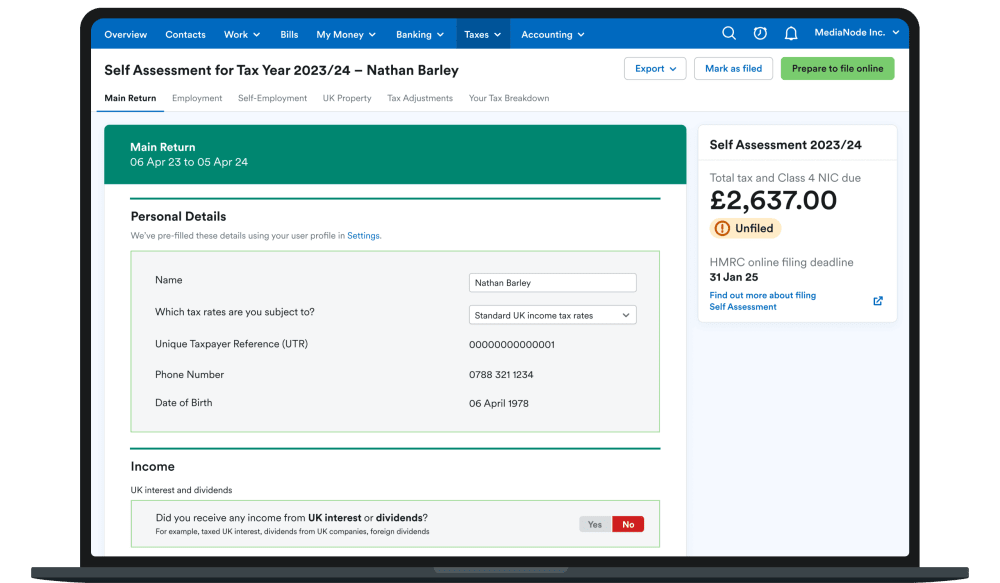

If you filed using FreeAgent

If you’ve made a mistake while filing your tax return using FreeAgent, it’s possible to unlock the return in the software and re-file it with HMRC. You can find step-by-step instructions on how to do this in our Knowledge Base. We strongly recommend that you consult with an accountant before making any corrections.

Once you’ve unlocked the return, you make the changes and then re-file your amended tax return to HMRC from FreeAgent. HMRC will then recalculate your tax bill based on your amended information. Your accountant can also make these changes in FreeAgent on your behalf.

Alternatively, your accountant might recommend that you make adjustments to account for the errors in the following tax year.

If you filed using pen and paper

If you filed your tax return to HMRC using pen and paper, you’ll need to print a new tax return form and mark the corrections clearly, using the instructions on HMRC’s website. You should then send the corrected tax return to HMRC in the post.

How soon can you amend a mistake in a filed tax return?

You can tackle an error on a filed tax return as soon as you notice it. There is, however, a deadline for correcting any mistakes: one year after the online filing deadline of the tax return that you want to correct.

If you made a mistake on your 2023/2024 tax return after you filed it to HMRC, for example, your deadline for correcting any mistakes would be 31st January 2026, one year after the online filing deadline of 31st January 2025. If you miss this deadline, you can still contact HMRC directly to explain the error.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.