What happens if you can’t pay your Self Assessment tax bill?

Even the most organised business owners can occasionally find themselves struggling to pay their Self Assessment tax bill on time. Business - like life - is complicated. Thankfully, there are some simple steps you can take to make payment arrangements with HMRC. Here’s how to take control of the situation.

Can’t pay your tax bill on time? Here’s what to do

If you can’t afford to pay your tax bill, there are some immediate actions you should take. The first thing is to determine whether the deadline for paying your Self Assessment tax bill has already passed.

If the Self Assessment deadline has not passed…

If you know in advance that you won’t be able to pay your Self Assessment tax bill by the deadline, don’t delay - as soon as you can, contact HMRC to set up a Time To Pay (TTP) arrangement. HMRC will work with you to set up affordable monthly payment options and negotiate time to pay whatever you owe based on what you can afford.

If you are unable to pay the full tax bill on time, you will have to pay interest on any tax you pay late and may also have to pay a penalty. However, that interest and any penalty fees can be included in a TTP arrangement.

If you are a partnership, HMRC will consider requests for a TTP arrangement from an authorised representative. They may not need to negotiate separately with each individual partner if the partnership meets certain criteria.

How HMRC calculates Time To Pay payments

Time to Pay arrangements are tailored to each individual’s circumstances. The length of the arrangement and the size of the monthly payments will be decided based on your personal income and expenditure, including monthly costs such as rent, food and utility bills. HMRC typically expects no more than 50% of your disposable income to be paid into the Time to Pay arrangement.

For businesses, HMRC will ask what the business can afford to pay and the length of the arrangement will depend on how much the business owes and the business’s financial circumstances. HMRC may also use any savings or assets you have to reduce the amount you need to pay.

TTP arrangements are often flexible and may be adjusted if your circumstances change. For example, the arrangement may be lengthened if your income is reduced, or shortened if you have a windfall and would like to make larger payments.

If the Self Assessment deadline has already passed…

If the deadline has recently passed, there’s still no need to panic - but you should contact HMRC as soon as possible. You can usually set up a Self Assessment payment plan up to 60 days after the payment deadline, provided that:

- you have filed your latest tax return

- you owe £30,000 or less

- you do not have any other payment plans or debts with HMRC

- you plan to pay your debt off within the next 12 months

You may have to pay a penalty for late filing and/or payment of your Self Assessment tax return, as well as any interest accrued on the tax owed. HMRC can usually account for this in your payment plan, so, at the very least, you shouldn’t have to pay anything extra up front.

Important: If you don’t meet the above criteria, or if it’s more than 60 days since your tax bill was due, you should call the Self Assessment Payment Helpline as soon as possible.

If you think HMRC has charged you the wrong amount

Whether it’s before or after the payment deadline, if you think HMRC has charged you the incorrect amount of tax and are worried about paying your tax bill, you should call HMRC’s Income Tax helpline as soon as possible.

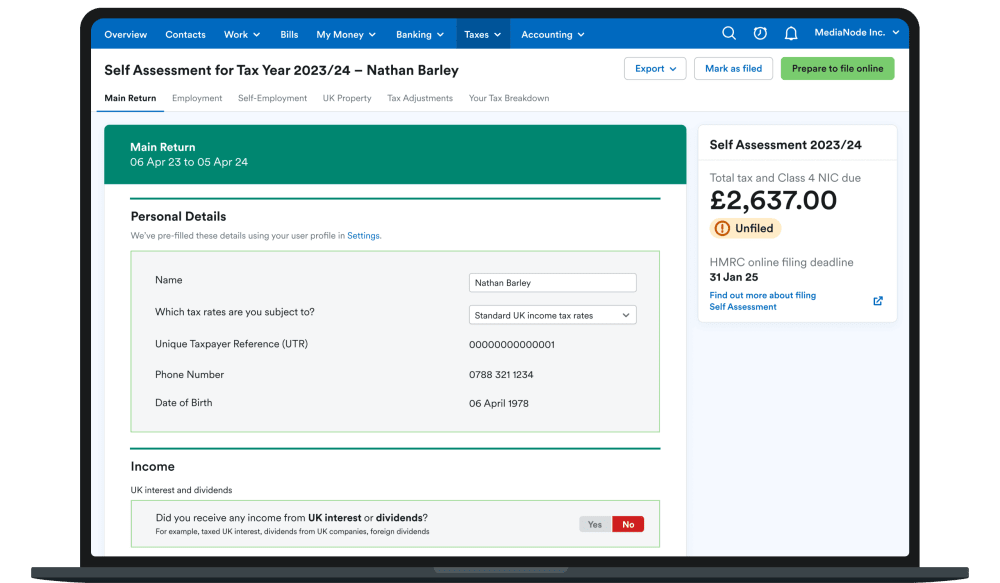

Avoid surprise tax bills with FreeAgent

FreeAgent gives you a real-time overview of your Self Assessment tax position so you’ll always know what you owe and you won’t be left scrambling at the last minute. Try a 30-day free trial of FreeAgent to see for yourself.

Originally published

Last updated

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.