Everything you need to know about HMRC tax investigations

An HMRC tax investigation can be stressful for any business, but there are ways that you can make the process as painless as possible.

Here’s our guide to HMRC tax investigations for small businesses.

What is an HMRC tax investigation?

HMRC has the right to check your affairs at any point to make sure you’re paying the right amount of tax. If your business is selected, you’ll receive an official HMRC investigation letter or phone call in which they’ll tell you what they want to look at. This might include things like:

- the tax that you pay

- your accounts and tax calculations

- your Self Assessment tax return for a given year

- your Company Tax Return

- your PAYE records and returns if you’re an employer

- your VAT returns and records if you’re VAT-registered

If you use an accountant, HMRC may contact them instead of you, but your accountant should be in touch to tell you about it.

The three types of tax investigation

There are three different levels of audit that HMRC can carry out:

1. Full enquiry

During a full enquiry, HMRC will review the entirety of your business records, usually because they believe that there is a significant risk of an error in your tax. When investigating limited companies, they might look closely into the tax affairs of company directors as well as the affairs of the business itself.

2. Aspect enquiry

As the name suggests, during an aspect enquiry HMRC will look at a particular aspect of your accounts, such as inconsistencies in a section of a recent tax return.

3. Random check

Just as it sounds, random checks can happen at any time – regardless of the state of your accounts or whether you’ve triggered an alert.

What does a tax investigation procedure involve?

During the investigation, a team from HMRC will audit your accounts and ask you a number of questions. They might ask to visit you in person at your home, business address or at your accountant’s office.

Which taxes can come under scrutiny?

Many people think that tax investigations are limited to Income Tax, but this isn’t the case and HMRC may want to look closely at a variety of things including:

If your business has complicated tax affairs, it’s worth investing in a good accounting software package to help make sure your accounts are always in order.

What triggers a tax investigation?

Any unusual activity in your tax records or accounts could flag you up for an HMRC tax compliance check.

Most checks are triggered by HMRC’s Central Risk team, who use sophisticated data mining tools to spot unusual activity on accounts or trends in particular industries.

The most common trigger for an investigation is submitting incorrect figures on a tax return - so it’s worth asking an accountant to offer professional advice about your accounts and check over your tax returns before you send them.

Other triggers include:

- the industry you work in being seen as ‘high risk’ (e.g. if there are a lot of ‘cash in hand’ transactions)

- someone alerting HMRC to unusual activity in your accounts

- noticeable inconsistencies between tax returns (e.g, a big fall in income from one year to the next)

- frequently filing tax returns late

- your accounts not matching the industry norms

Your accounts may simply be selected at random for investigation, even if your books are in order and you always file tax on time.

How far back can HMRC go during an investigation?

The tables below show the tax investigation time limits within which HMRC can go back and audit your accounts. The length of time they can go back depends on the seriousness of the investigation:

| Time limit for normal behaviour, e.g. a Self Assessment random check on your tax return (years) | |

|---|---|

| Capital Gains | 4 |

| Corporation Tax | 4 |

| Income Tax | 4 |

| PAYE | 4 |

| VAT | 4 |

| Time limit for careless behaviour, e.g. failure to self assess correctly (years) | |

| Capital Gains | 6 |

| Corporation Tax | 6 |

| Income Tax | 6 |

| PAYE | 6 |

| VAT | 4 |

| Time limit for deliberate behaviour, e.g. tax fraud (years) | |

| Capital Gains | 20 |

| Corporation Tax | 20 |

| Income Tax | 20 |

| PAYE | 20 |

| VAT | 20 |

Top tips for your accounts

Now you know the basics of what a tax investigation involves, here are our top tips on how to keep your accounts in order.

Don’t put off the paperwork - keep your books up to date

It’s vital to update your business books regularly. This isn’t just because HMRC requires you to do so, but it’s also essential to know what’s going on with your business finances.

When your records are up to date, not only can you pick up on crucial information quickly (such as whether customers haven’t paid you on time), you can also easily respond to any HMRC audit enquiries without the stress of searching for scraps of paper.

Here are the three most important things you can do to keep your books in order:

1. Make sure your bank account balance matches the balance shown in your accounting software

If you use FreeAgent, connecting your bank account allows you to import your bank transactions into the software automatically so you don’t have to key in any data. Choose an explanation for each transaction (e.g. ‘stationery’ or ‘travel’) to keep your accounts up to date.

Find out more about banking in FreeAgent

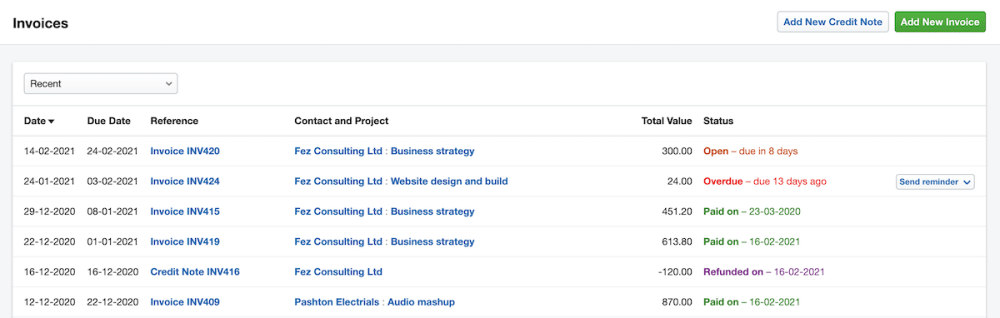

2. Keep copies of invoices for all the money you’ve received

In FreeAgent, you can record all the invoices that you’ve sent and see which have been paid, and which are due and overdue, at a glance. The Invoice Timeline on your FreeAgent Dashboard lets you see who owes you what, making it far easier to chase up late-paying customers.

Find out more about invoicing in FreeAgent

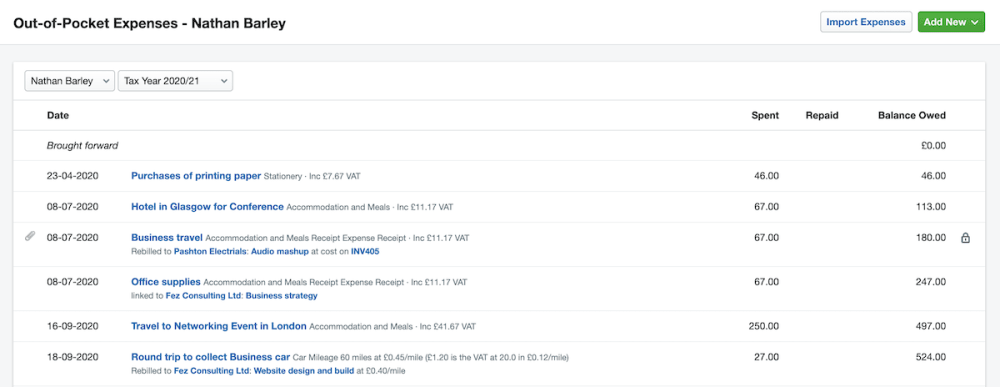

3. Keep copies of receipts for all costs in your business

FreeAgent makes it easy to keep track of all the expenses you incur when running your business, and in most cases, HMRC will accept scanned receipts instead of hard copies. Using the FreeAgent mobile app, you can snap your expense receipts and upload them to your FreeAgent account while you’re on the go.

Find out more about expenses in FreeAgent

Avoid basic accounting errors that might trigger an automatic tax investigation

It’s important to make sure that your records are not only up to date, but as error-free as possible. If you’ve got a problem in your books, ask your accountant for guidance.

Here are a few common errors that you should look out for in your accounts:

- allocating costs to the wrong category

- posting costs as out-of-pocket expenses rather than bank payments (or vice versa)

- entering the wrong amount of VAT

- treating a cost as tax-deductible when it isn’t (or the other way round)

- matching receipts to the wrong invoice

If you don’t yet have an accountant and you feel that your books are getting on top of you, now is the time to look into it. Take a look at our directory of accountants to find a practice that suits your business.

You could try automating some of your day-to-day bookkeeping with FreeAgent – take a 30-day free trial to find out how it can help you to nail the daily admin.

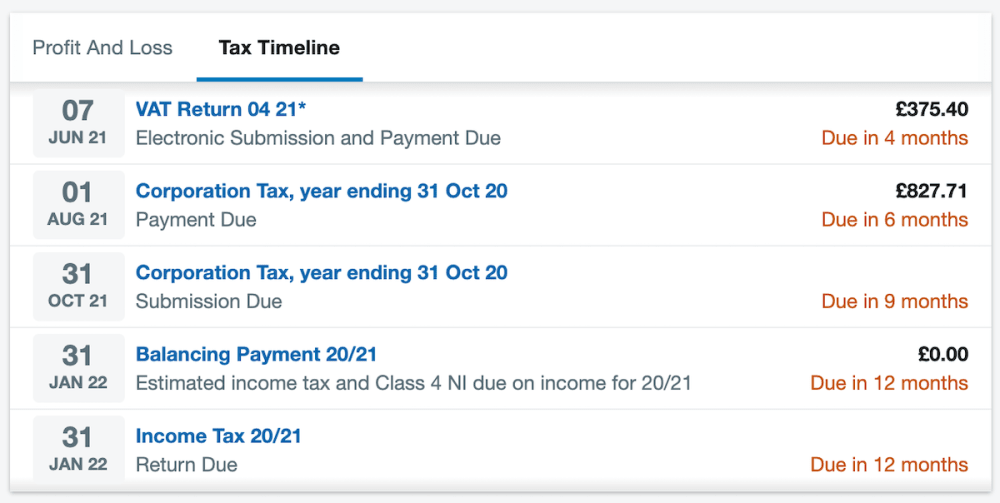

File your Self Assessment and VAT returns on time

Remember that HMRC is more likely to select your accounts for review if you submit tax or VAT returns late. FreeAgent provides a unique tax timeline that shows live updates of your tax position and upcoming deadlines.

As you go about your daily business, FreeAgent works away in the background, calculating your tax liability so you can file Self Assessment tax returns and MTD-compatible VAT returns directly to HMRC from the software.

Based on the data you enter throughout the year, FreeAgent populates your Self Assessment tax returns and VAT returns with much of the information that HMRC requires. For sole traders, FreeAgent completes parts of the Self Employment page of the Self Assessment tax return.

When it’s time to file, all you need to do is check the data, fill in the missing details and then submit your Self Assessment tax return or MTD-compatible VAT return directly to HMRC.

You can also give your accountant access to your FreeAgent account so they can check that the information on your returns is correct and, if you give them authority to do so, even file on your behalf.

Remember, when you have tidy, up-to-date records, you’ll not only be ready if HMRC opens an enquiry, but you’ll also know how your business is doing on a day-to-day basis. This will enable you to sort out any problems in your accounts before they become major issues.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.