Where to find a business’s VAT number

All of your business’s VAT-registered suppliers will have a unique registration number. If your business is also VAT registered, you’ll need your own supplier’s VAT number in order to reclaim any VAT you’ve paid to your suppliers.

This handy guide will help you understand what a VAT registration number is, why it’s important and where to find it.

What is a VAT registration number?

A VAT number is a unique ID that HMRC provides to businesses when they register for VAT. In the UK, VAT numbers are nine digits long and always have the prefix ‘GB’.

If you’re dealing with a supplier in another EU country then its VAT number will follow a different format, with its own unique country code. HMRC provides a list of ID formats from European Union member states on its website.

Why is it important?

If you reclaim VAT without a valid VAT number from your supplier, it could lead to HMRC rejecting your claim. If this happens, you could be left footing the bill or dealing with a severe amount of admin to rectify the situation!

Where can I find it?

When you’re looking for the VAT number of another business, your first port of call should be any invoice it has supplied to you. If the business is registered for VAT then its unique ID should be listed on all of their invoices.

If you pay VAT to a supplier but there is no registration number on the invoice they provide you should contact them immediately – you’ll need to have a valid VAT invoice from them in order to reclaim any VAT they’ve charged you.

How to check that a VAT number is valid

There are a few ways to check that a VAT registration number is valid:

1. Call the HMRC VAT helpline

HMRC has a complete database of VAT-registered businesses, so if you’re in any doubt about a registration number you should call their VAT helpline on 0300 200 3700.

2. Use the HMRC website

HMRC also provides an online service for checking UK VAT numbers. You can use this tool to check if a UK VAT registration number is valid as well as to find the name and address of the business the number is registered to.

If the supplier’s VAT registration is shown as invalid by HMRC, you should contact them to get the right VAT number as soon as you can.

3. Use the VIES website

You can use the European Union’s VAT Information Exchange System (VIES) to check the validity of VAT numbers in EU member states. By entering the registration numbers and relevant country codes into the fields provided, you can check if an EU supplier’s VAT number is valid.

If the supplier’s VAT registration is shown as invalid by VIES, you should contact them to get the right VAT number as soon as you can.

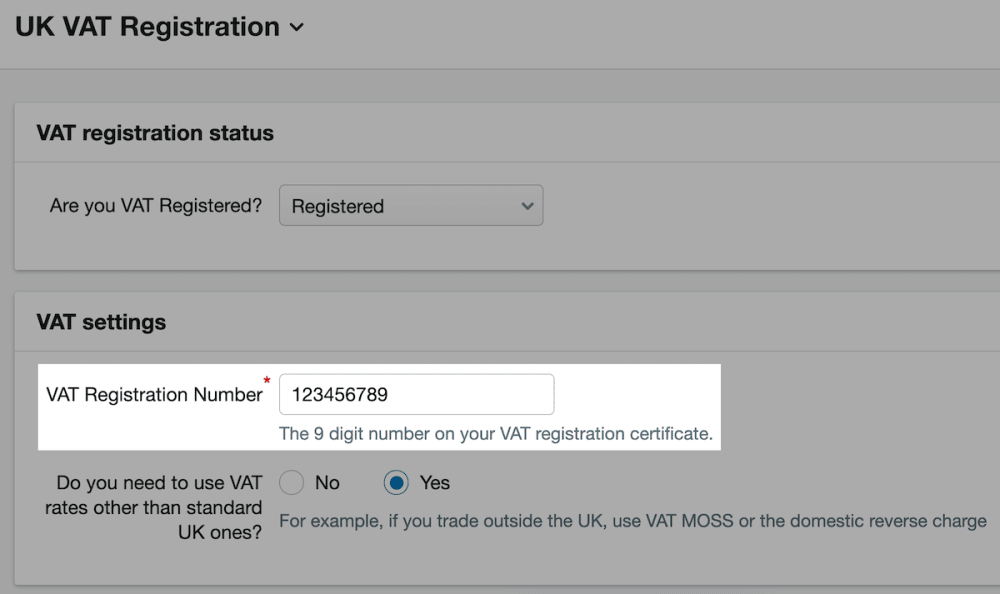

Your business’s VAT number in FreeAgent

If your business is VAT registered, FreeAgent will automatically add your VAT number to any invoices you send from the software. You can also submit MTD-compatible VAT returns directly to HMRC from your account.

Find out more about how FreeAgent tackles the complexities of the UK VAT system to calculate what you owe.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.